Introduction

Welcome to our comprehensive guide on understanding Return on Net Worth (RoNW), an essential metric for evaluating financial performance and stability. Whether you’re striving for personal financial growth or a business aiming to enhance profitability, understanding RoNW and implementing effective strategies can significantly impact your financial success. This article will delve deep into what RoNW is, why it matters, and actionable tips to enhance it.

What is Return on Net Worth (RoNW)?

Return on Net Worth (RoNW) measures the efficiency of utilizing net worth to generate profits or returns. It’s a key indicator of financial health and performance, reflecting how effectively an entity leverages its net assets to generate income. RoNW is calculated by dividing net income by net worth and is stated in percentage.

Return on Net Worth Formula

RoNW is calculated by dividing net income by net worth and expressing the result as a percentage. The formula breakdown is as follows:

RoNW= (Net Income/Net Worth)×100

Net Income: This represents the company’s total income after deducting all expenses, taxes, and interest payments. It reflects the profitability of the business operations.

The formula for calculating Net Income is:

Net Income = Total Revenue – Total Expenses – Interest Expenses – Taxes

Net Worth: Also known as shareholders’ equity, net worth represents the total assets minus liabilities. It indicates the ownership interest of shareholders in the company’s assets after accounting for debts and obligations.

The formula for calculating Net Worth is:

Net worth = Total Assets – Total Liabilities

Pros and Cons of Return on Net Worth

Pros RoNW:

- Comprehensive Indicator: RoNW provides a holistic view of financial performance, considering both profitability and asset utilization.

- Comparative Analysis: It allows for easy comparison across different entities within the same industry or sector.

- Strategic Insights: Help identify areas for improvement in resource allocation and profitability enhancement.

Cons RoNW:

- Dependent on Accounting Practices: RoNW can be influenced by accounting methods and adjustments, affecting its accuracy.

- Limited by Historical Data: It relies on past financial performance, which may not accurately reflect prospects.

- Doesn’t Consider Risk: RoNW does not account for the risk of generating profits, overlooking the potential impact on long-term sustainability.

Limitations of Return on Net Worth

While Return on Net Worth (RoNW) is a valuable metric for assessing financial performance, it’s essential to consider its limitations:

- Dependence on Accounting Practices: RoNW can be influenced by accounting methods and adjustments, affecting its accuracy and comparability across entities.

- Historical Data: RoNW relies on past financial performance, which may not accurately reflect prospects or changes in market conditions.

- Risk Ignorance: RoNW does not consider the risk associated with generating profits, overlooking factors such as market volatility, regulatory changes, and competitive pressures.

Importance of Maximizing RoNW

Maximizing RoNW holds immense importance for individuals, businesses, and investors due to several compelling reasons:

- Efficient Resource Allocation: A high RoNW indicates efficient utilization of resources, ensuring optimal allocation of capital and assets.

- Profitability: Increasing RoNW directly correlates with improved profitability, enhancing overall financial stability and growth potential.

- Risk Management: A strong RoNW provides a buffer against financial risks and economic downturns, safeguarding against potential losses.

- Investor Confidence: Investors and stakeholders often use RoNW as a critical metric to assess an entity’s financial performance and attractiveness, influencing investment decisions.

Strategies for Maximizing Return on Net Worth

Now, let’s explore actionable strategies to enhance RoNW:

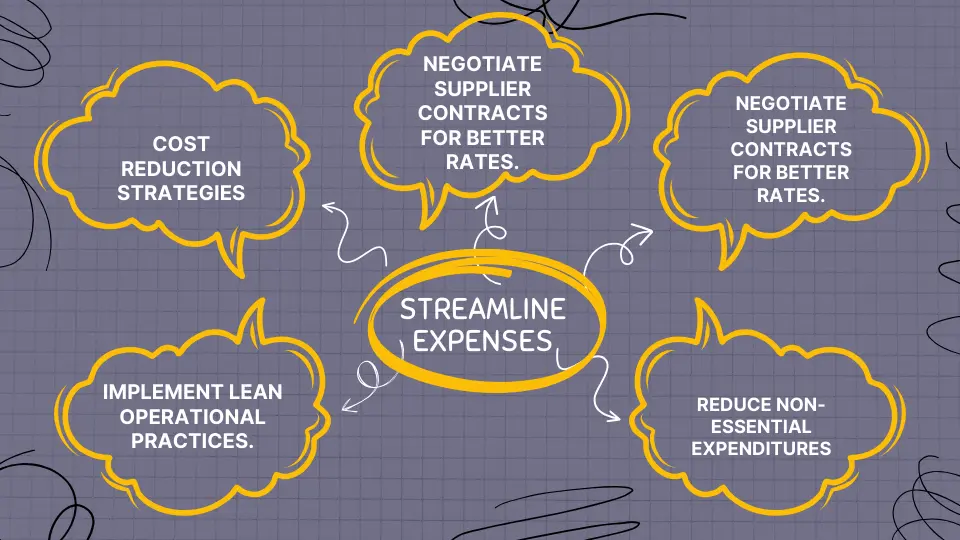

1. Streamline Expenses

Efficient cost management is paramount for maximizing RoNW. Identify areas of unnecessary spending and implement cost-saving measures. It could involve renegotiating contracts with suppliers, optimizing operational processes, or reducing discretionary expenses. Additionally, leveraging technology solutions for automation and efficiency can further streamline costs.

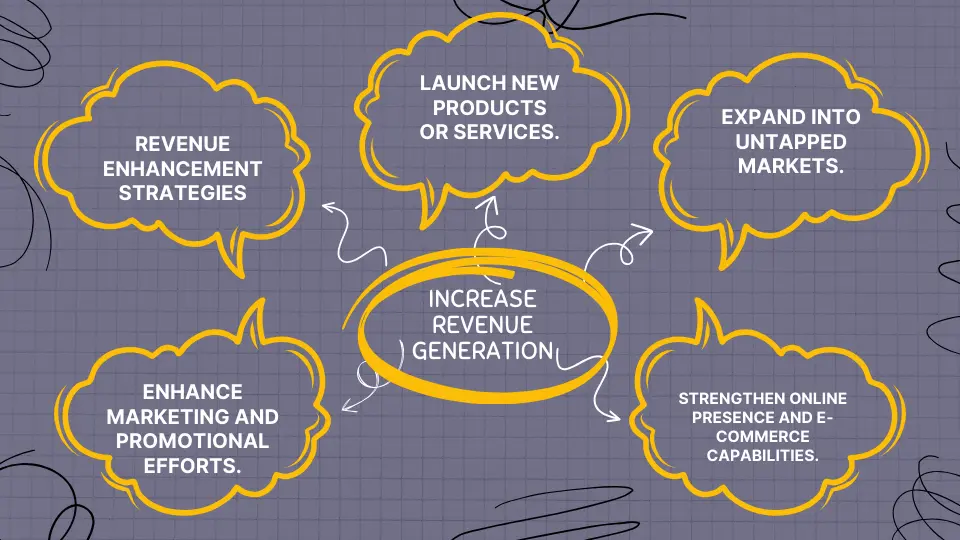

2. Increase Revenue Generation

Boosting revenue streams is instrumental in improving RoNW. Explore opportunities to diversify income sources, expand market reach, and enhance product/service offerings. It may involve launching new products, entering new markets, improving customer engagement through targeted marketing efforts, and leveraging digital platforms for e-commerce expansion.

3. Optimize Debt Management

Prudent debt management plays a pivotal role in maximizing RoNW. Focus on reducing high-interest debt, refinancing loans for better terms, and avoiding excessive leverage. Prioritize debt repayment to improve financial flexibility and reduce interest expenses. Additionally, consider consolidating debts and exploring debt-restructuring options to alleviate financial burdens.

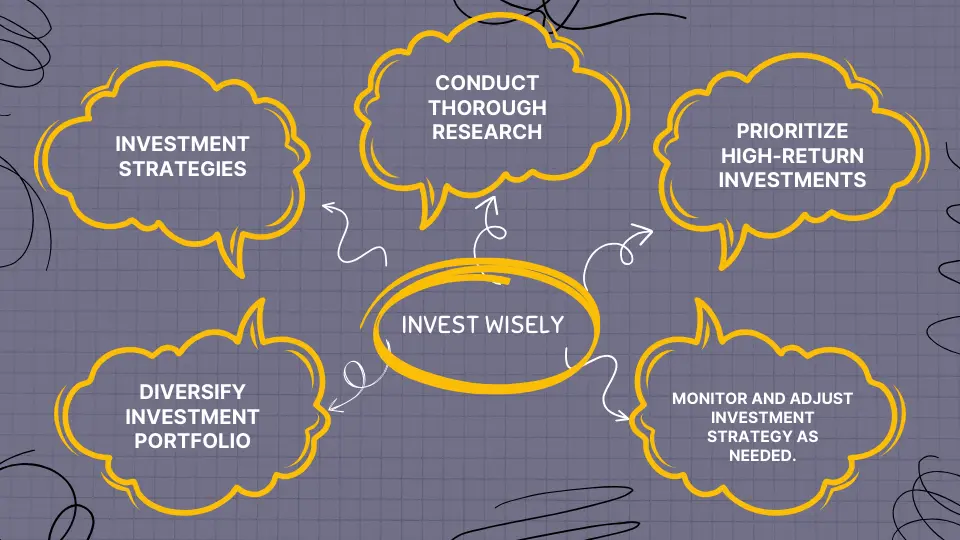

4. Invest Wisely

Strategic investments can significantly impact RoNW. Conduct thorough analysis and research before making investment decisions. Prioritize investments with high potential returns while managing associated risks effectively. Diversify investment portfolios to minimize risk exposure and capitalize on asset classes such as stocks, bonds, real estate, and alternative investments.

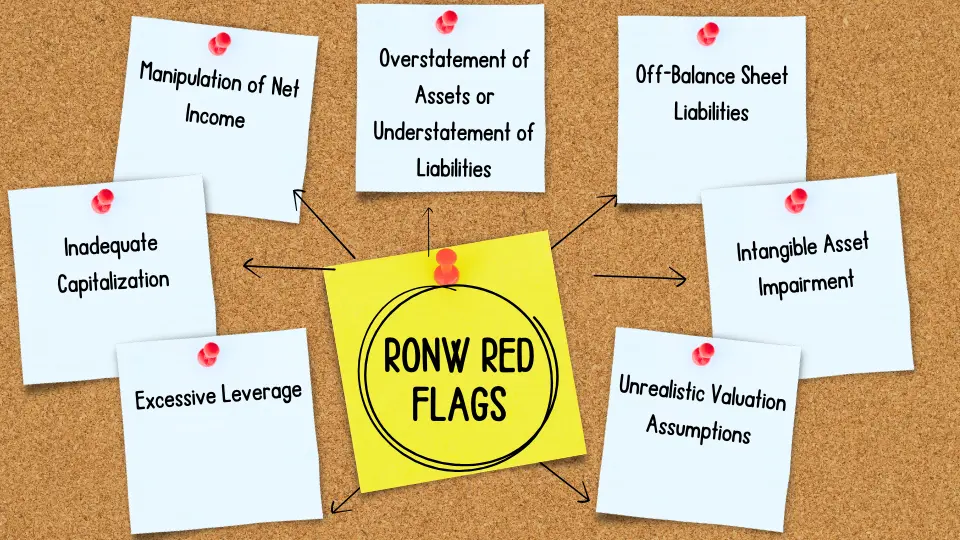

RoNW Financial Shenanigans and Red Flags

While RoNW is a valuable metric, some financial shenanigans or red flags may distort its interpretation or lead to misleading conclusions:

- Manipulation of Net Income: Companies may use earnings management practices to inflate or deflate net income, thereby impacting RoNW artificially. Common tactics include aggressive revenue recognition, expense deferral, and one-time adjustments to earnings.

- Overstatement of Assets or Understatement of Liabilities: Manipulating the components of net worth can distort RoNW. Companies may overstate the value of assets or understate liabilities to inflate net worth artificially, leading to an inflated RoNW figure.

- Off-Balance Sheet Liabilities: Companies may use off-balance sheet financing to hide debt obligations or lease liabilities, resulting in an understatement of liabilities and an inflated RoNW ratio.

- Intangible Asset Impairment: Failure to recognize impairment charges on intangible assets such as goodwill can inflate net worth and, consequently, RoNW. Companies may delay or avoid impairment recognition to maintain higher reported net worth.

- Unrealistic Valuation Assumptions: Using aggressive or unrealistic valuation assumptions for assets or goodwill can artificially inflate net worth and RoNW. It may occur during mergers and acquisitions or asset revaluation exercises.

- Excessive Leverage: High debt levels can artificially inflate RoNW in the short term by boosting net worth through leverage. However, excessive leverage increases financial risk and may lead to financial distress if not managed prudently.

- Inadequate Capitalization: Companies with insufficient capitalization may exhibit artificially high RoNW ratios due to a lower net worth denominator. However, inadequate capitalization can indicate financial vulnerability and hinder long-term growth prospects.

How to Use Return on Net Worth Correctly?

To use Return on Net Worth (RoNW) effectively, consider the following guidelines:

- Contextual Analysis: Evaluate RoNW in conjunction with other financial metrics and industry-specific factors to gain a comprehensive understanding of economic performance.

- Long-Term Perspective: Consider RoNW trends over time to assess financial performance’s sustainability and identify improvement areas.

- Benchmarking: Compare RoNW with industry averages or competitors’ performance to gauge relative performance and identify opportunities for optimization.

- Risk Assessment: Supplement RoNW analysis with risk assessment to ensure a balanced financial health and profitability perspective.

RoNW in Conjunction with Other Metrics

| Metric | Description |

| Return on Assets (ROA) | Measures the profitability of assets by comparing net income to total assets. |

| Return on Equity (ROE) | Evaluate the profitability of shareholder equity by comparing net income to shareholder equity. |

| Debt-to-Equity Ratio | Indicates the proportion of debt to equity and assesses financial leverage and risk. |

| Gross Profit Margin | Measures the revenue percentage surpassing the cost of goods sold, indicating operational efficiency and profitability. |

Return on Net Worth Sector-Specific Factors

| Sector | Key Factors |

| Banking and Finance | Interest rates, loan portfolio quality, regulatory compliance, and economic conditions. |

| Retail | Consumer spending trends, competition, inventory management, online vs. brick-and-mortar sales. |

| Technology | Innovation, product lifecycle, intellectual property, market demand, competition. |

| Healthcare | The regulatory environment, healthcare policies, research and development, and patient demographics. |

| Manufacturing | Supply chain management, production efficiency, raw material costs, global trade dynamics. |

| Real Estate | Property location, market demand, rental yields, property management, economic conditions. |

| Energy | Commodity prices, geopolitical factors, exploration and production costs, regulatory environment. |

| Consumer Goods | Brand loyalty, marketing strategies, consumer preferences, distribution channels, competitive landscape. |

| Hospitality and Tourism | Seasonal trends, travel patterns, destination popularity, hotel occupancy rates, tourism infrastructure. |

| Automotive | Consumer demand, technological advancements, regulatory standards, supply chain disruptions. |

Next let’s delve deeper into the relevance and irrelevance of RoNW across various sectors:

Relevant Sectors for Return on Net Worth (RoNW):

- Banking and Finance: RoNW holds significant relevance in the financial and banking sectors due to the capital-intensive nature of operations. Banks and financial institutions rely on efficiently utilizing capital to generate profits, making RoNW a critical metric for evaluating their financial performance and stability.

- Oil & Gas: In the oil and gas (energy) sector, where companies undertake large-scale exploration, production, and refining activities, RoNW is a valuable indicator of profitability and asset utilization. It helps assess how effectively companies leverage their net assets to generate returns amidst volatile commodity prices and regulatory challenges.

- Consumer Durables: RoNW is relevant in the consumer durables sector, encompassing industries involved in manufacturing and selling durable goods such as appliances, electronics, and home furnishings. Efficient utilization of capital and assets is crucial for profitability in this sector, making RoNW a key metric for performance evaluation.

- Retailing: Retail companies operate in a highly competitive environment where profitability hinges on inventory management, supply chain efficiency, and consumer demand trends. RoNW helps retailers gauge their financial health by analyzing how effectively they convert net worth into profits and returns.

- FMCG (Fast-Moving Consumer Goods): In the FMCG sector, which includes products with a high turnover rate and relatively low cost, RoNW is instrumental in assessing operational efficiency and profitability. Companies manufacturing and distributing fast-moving consumer goods rely on RoNW to evaluate their ability to generate returns on invested capital.

- Pharmaceuticals & Biotechnology: RoNW plays a vital role in the pharmaceutical and biotechnology sectors, where companies invest heavily in research, development, and regulatory compliance. Evaluating RoNW helps assess the effectiveness of investments in innovation, manufacturing processes, and market expansion strategies.

- Software & Services: Technology companies, particularly those involved in software development and service provision, rely on RoNW to evaluate profitability and return on intellectual property investments. RoNW analysis provides insights into how efficiently these companies convert net assets into profits and shareholder value.

Irrelevant Sectors for Return on Net Worth (RoNW):

- Metals & Mining: In industries like metals and mining, where profitability is heavily influenced by factors such as commodity prices, production volumes, and operational efficiency, RoNW may have limited relevance. The focus in these sectors is more on cost management, production optimization, and market demand dynamics.

- Healthcare Equipment & Supplies: While profitability is essential in healthcare, RoNW may be less relevant in sectors focused on equipment and supplies. Technological innovation, regulatory compliance, and market demand are more significant in determining success than net worth-based metrics.

- Textiles, Apparel & Accessories: Industries centred around fashion and apparel are driven by factors like consumer preferences, fashion trends, and brand positioning, making RoNW less relevant. Profitability in these sectors depends heavily on marketing strategies, product differentiation, and supply chain management.

- Cement and Construction: RoNW may have limited relevance in cement and construction sectors, where project execution, construction costs, and infrastructure investments influence profitability. These industries focus more on operational efficiency and project profitability than net worth-based metrics.

- Coal: With the declining demand for coal and increasing environmental regulations, RoNW may have limited relevance in the coal sector. Companies in this industry face challenges related to market demand, regulatory pressures, and the transition to cleaner energy sources, making RoNW less applicable as a performance metric.

Conclusion

In conclusion, understanding Return on Net Worth (RoNW) and its associated financial shenanigans and red flags is essential for individuals, businesses, and investors seeking to maximize financial performance and stability. By considering the limitations of RoNW and employing strategic analysis techniques, such as contextual assessment, long-term perspective, and comparative analysis, stakeholders can make informed decisions and mitigate risks effectively.

Moreover, understanding the relevance and irrelevance of RoNW across various sectors enables tailored financial analysis and strategic planning, ensuring alignment with sector-specific dynamics and objectives. Ultimately, by leveraging RoNW alongside other financial metrics and sector-specific factors, stakeholders can enhance their ability to maximize financial performance and drive sustainable growth.

Frequently Asked Questions (FAQs) about Return on Net Worth (RoNW)

What is Return on Net Worth (RoNW)?

Return on Net Worth (RoNW) is a financial metric used to evaluate the efficiency of utilizing net worth to generate profits or returns. It measures the percentage of net income created relative to the net worth of a company or individual.

How is Return on Net Worth (RoNW) Calculated?

Return on Net Worth (RoNW) is calculated by dividing the net income by the net worth and expressing the result as a percentage. The formula for RoNW is RoNW = (Net Income / Net Worth) × 100.

Why is Return on Net Worth (RoNW) Important?

Return on Net Worth (RoNW) is vital because it provides insights into an entity’s profitability and financial health. It helps stakeholders assess how effectively resources are utilized to generate returns, aiding decision-making and strategic planning.

What are the Pros of Using RoNW?

The pros of using RoNW include its comprehensive nature, allowing for a holistic view of financial performance. It also facilitates comparative analysis across entities within the same industry. It provides strategic insights for resource allocation and profitability enhancement.

What are the Cons of Using RoNW?

Some cons of using RoNW include its dependence on accounting practices, which can influence its accuracy and comparability. Additionally, RoNW relies on historical data and may not accurately reflect prospects or changes in market conditions.

How Can I Maximize RoNW?

To maximize RoNW, focus on streamlining expenses, increasing revenue generation, optimizing debt management, and making wise investments. Implementing cost-saving measures, diversifying income sources, and managing debt can improve RoNW.

What Are the Red Flags to Watch Out for Regarding RoNW?

Red flags associated with RoNW include manipulation of net income, overstatement of assets or understatement of liabilities, off-balance sheet liabilities, unrealistic valuation assumptions, excessive leverage, and inadequate capitalization. These factors can distort the interpretation of RoNW and signal potential financial shenanigans.

Is RoNW Relevant Across All Industries?

While RoNW is relevant across many industries, its applicability may vary depending on sector-specific factors. Industries with capital-intensive operations and high asset utilization, such as banking and finance, retail, and technology, tend to emphasize RoNW more. However, sectors driven by other performance metrics, such as fashion and apparel or construction, may find RoNW less relevant.

How Should I Use RoNW Correctly?

To use RoNW correctly, conduct contextual analysis by evaluating it with other financial metrics and sector-specific factors. Maintain a long-term perspective, benchmark against industry peers, and assess risks associated with generating profits. By employing a comprehensive approach to RoNW analysis, stakeholders can make more informed decisions and drive sustainable growth.

What Are Some Tips for Enhancing RoNW?

Strategies for enhancing RoNW include streamlining expenses, increasing revenue generation, optimizing debt management, and making wise investments. Implementing cost-saving measures, expanding market reach, prioritizing debt repayment, and conducting thorough research before making investment decisions can improve RoNW effectively.

Disclaimer:

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research/Mutual Fund Focus and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Conduct your research with registered financial advisors before making any investment decisions. Ace Equity Research/Mutual Fund Focus and the team are not accountable for the investment views provided in the article.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.