Introduction

Tata Technologies, a prominent global engineering and product development services company based in Pune, India, has caught the attention of investors with its upcoming Tata Technologies IPO (Initial Public Offering). If you are considering investing in this company, it is essential to understand its background, current operations, and its role in shaping the future of mobility and electric vehicles.

Tata Technologies’ Past

From Automotive Design Unit to Independent Company

Tata Technologies traces its roots back to 1989, when it started as the automotive design unit of Tata Motors. However, recognizing its potential as a separate entity, Tata Motors spun off Tata Technologies as an independent company in 1994. Despite becoming independent, Tata Motors remained the majority stakeholder and a significant client of Tata Technologies.

Strategic Acquisitions

Tata Technologies made strategic acquisitions to enhance its capabilities and expand its global presence. In 2005, the company acquired INCAT International, an automotive and aerospace engineering company based in the UK and the US. This acquisition further bolstered Tata Technologies’ expertise and client base.

In 2011, Tata Technologies sold a 13% stake to Tata Capital and Alpha TC Holdings, raising ₹141 crore (US$30 million). This strategic move strengthened the company’s financial position and opened avenues for collaboration and growth.

Another significant acquisition came in April 2013 when Tata Technologies acquired Cambric Corporation, an American engineering services company, for $32.5 million. This acquisition expanded the company’s presence in the American market and added to its technical capabilities.

Tata Technologies at Present

Global Presence and Workforce

With a workforce of over 10,000 employees spread across 24 countries, Tata Technologies operates globally. Its presence extends beyond India to North America, Europe, Asia, and Africa, enabling the company to effectively serve clients from various regions and industries.

Diverse Portfolio of Products and Services

Tata Technologies offers many services and products to meet their client’s needs. Its core offerings include:

- Digital Enterprise Solutions (DES): Tata Technologies provides innovative digital solutions to enable clients to optimize their operations and improve efficiency. These solutions encompass product lifecycle management, manufacturing operations management, and connected enterprise.

- Engineering and Product Development Services: Leveraging its deep engineering expertise, Tata Technologies assists clients in developing cutting-edge products and bringing them to market efficiently. The company’s services cover concept design, virtual validation, prototyping, and testing.

- Digital Manufacturing Solutions: Tata Technologies helps clients transform their manufacturing processes by implementing advanced digital technologies. It includes factory layout optimization, robotics and automation, and supply chain management.

- Simulation and Testing Services: Using state-of-the-art simulation and testing tools, Tata Technologies enables clients to validate and optimize their designs, ensuring robustness and performance. It encompasses virtual prototyping, structural analysis, fluid dynamics, and more.

- Training and Consulting Services: Tata Technologies offers training programs and consulting services to empower clients with knowledge and expertise. These programs cover various domains, including design, manufacturing, and digital transformation.

Overview of the Tata Technologies IPO

Tata Technologies filed its draft red herring prospectus (DRHP) with the SEBI (Securities and Exchange Board of India) on March 9, 2023, to initiate its IPO process. The company plans to raise ₹9,571 crore through the IPO.

The IPO will consist of an offer for sale (OFS) of 9.571 crore shares by existing shareholders, including Tata Motors, Alpha TC Holdings Pte, and Tata Capital Growth Fund-I. The price band for the IPO has yet to be determined, but the current grey market premium (GMP) is approximately ₹582 per share.

The IPO is scheduled to open on June 28, 2023, and close on July 1, 2023. Tata Technologies’ shares will be listed on the BSE and the NSE (National Stock Exchange).

Key Highlights of the Tata Technologies IPO

- Issue Size: Up to ₹9,571 crore

- Offer for Sale: 9.571 crore shares

- Grey Market Premium (GMP): ₹582 per share

- Open Date: June 28, 2023

- Close Date: July 1, 2023

- Listing Dates: BSE and NSE

- Price Band: Not yet set

Benefits of Tata Technologies Going Public

Tata Technologies expects several benefits from its IPO:

- Access to Capital: Going public will enable Tata Technologies to raise funds that can be utilized for expansion, global reach, and investment in new technologies. It will support the company’s growth objectives.

- Liquidity: The IPO will create a public market for Tata Technologies’ shares, providing liquidity to existing shareholders and making it easier for new investors to buy and sell shares.

- Brand Awareness: Going public will enhance Tata Technologies’ brand awareness and visibility in the market, attracting new customers and strengthening its position in the industry.

- Alignment with Tata Motors’ Strategy: The IPO allows Tata Motors to reduce its stake in Tata Technologies, aligning with its focus on the core automotive business while providing growth opportunities for Tata Technologies.

Why Invest in Tata Technologies IPO?

There are several reasons why investors may want to consider investing in Tata Technologies IPO. These include:

- Industry Growth Potential: The company is well-positioned to benefit from the growth of the automotive, aerospace, and defence industries. These industries are all expected to grow significantly in the coming years, and Tata Technologies is well-positioned to capitalize on this growth.

- Strong Track Record of Growth: Tata Technologies has demonstrated a strong track record. Its revenue has grown at a CAGR (compound annual growth rate) of 15.3% over the past five years. This consistent growth indicates the company’s ability to adapt to market demands and deliver value to its customers.

- Experienced Management Team: Tata Technologies has a solid and professional management team. The team is led by CEO (Chief Executive Officer) and MD (Managing Director) Warren Harris, who brings industry knowledge and expertise. Their leadership has been instrumental in driving the company’s success and navigating the challenges of a dynamic market.

Profit and Loss Statement Analysis

Tata Technologies has showcased consistent revenue and profit growth over the years, indicating its ability to adapt to market demands and deliver value. In FY 2016, the company’s revenue stood at ₹2,683.38 crores, which increased to ₹3,529.57 crores in FY 2022. Similarly, the profit grew from ₹371.66 crores in FY 2016 to ₹436.97 crores in FY 2022. This steady growth demonstrates the company’s strong market position and customer service demand.

Earnings per Share (EPS) Growth

Earnings per Share (EPS) is a significant financial metric that indicates a company’s profitability and ability to generate shareholder returns. Tata Technologies has witnessed a positive trend in its EPS. It rose from ₹5.06 in FY 2016 to ₹6.09 in FY 2022.

This growth signifies that the company has consistently generated higher earnings for each outstanding share, which is favourable for potential investors.

Stable Operating and Net Profit Margins

Operating and net profit margins are essential indicators of a company’s operational efficiency and profitability. Tata Technologies has maintained a stable operating margin of around 14% in recent years, demonstrating its ability to generate a healthy profit from its operational activities.

The net profit margin has also remained around 12%, indicating the company’s effectiveness in retaining a significant portion of its earnings after expenses and taxes.

Manageable Debt Levels

Managing debt is crucial for a company’s financial stability. Tata Technologies has maintained relatively stable debt levels, with an approximate debt amount of ₹1,500 crores. It indicates that the company is not heavily burdened by debt, providing it with financial flexibility to pursue growth opportunities and strategic initiatives. It also shows a favourable debt-to-equity ratio, reflecting the company’s ability to manage its financial obligations effectively.

Positive Cash Flow from Operations

Cash flow is a critical aspect of evaluating a company’s financial health. Tata Technologies has demonstrated positive cash flow over the past five years. It indicates that the company generates enough cash from its core business activities to cover expenses, invest in growth opportunities, and potentially distribute dividends to shareholders. Positive cash flow highlights the company’s ability to fund its operations and future expansion.

Key Takeaways from the Profit and Loss Statement Analysis

Based on the profit and loss statement analysis of Tata Technologies, here are some key takeaways:

- The company has showcased steady revenue and profit growth over the years.

- Tata Technologies has maintained a stable operating margin and net profit margin.

- The company has manageable debt levels, providing financial flexibility.

- Positive cash flow from operations highlights its ability to generate sufficient cash.

Balance Sheet Analysis

Analyzing Tata Technologies’ balance sheet provides insights into the company’s assets, liabilities, and equity structure.

Tata Technologies Assets

The company possesses substantial current assets that can be converted into cash within one year. As of March 31, 2023, Tata Technologies had a current ratio of 2.11, indicating that it holds 2.11 times more current assets than current liabilities. It suggests that the company has a strong liquidity position.

Furthermore, Tata Technologies’ fixed assets, including net property, plant, and equipment (PPE), amounted to ₹2,375.03 crores as of March 31, 2023. These fixed assets contribute to the company’s long-term value and operational capabilities.

Tata Technologies Liabilities

Tata Technologies has manageable current liabilities that must be paid within one year. With a debt-to-equity ratio(Debt/Equity) of 0.41 as of March 31, 2023, the company carries 0.41 times more debt than equity. It indicates a favourable financial structure, with a relatively low level of debt compared to its equity.

Additionally, the company’s long-term liabilities, payable after one year, amount to ₹1,467.66 crores as of March 31, 2023. These liabilities are well-managed and reflect the company’s responsible approach to long-term financial commitments.

Tata Technologies Equity

Tata Technologies demonstrates substantial shareholders’ equity, reflecting the company’s value that belongs to its shareholders. As of March 31, 2023, Tata Technologies had a book value per share of ₹30.09, indicating a solid equity position. It highlights the company’s overall financial stability and the confidence it instils in its investors.

Key Takeaways from the Balance Sheet Analysis

Here are some key takeaways from the balance sheet analysis of Tata Technologies:

- The company possesses a strong balance sheet with a good mix of current and fixed assets.

- Tata Technologies maintains a manageable debt-to-equity ratio.

- Shareholders’ equity is substantial, indicating the company’s overall financial strength.

Cash Flow Statement Analysis

The cash flow statement provides insights into how Tata Technologies generates and utilizes cash.

Cash Flow from Operations

Tata Technologies has demonstrated vital cash flow from operations in recent years. It indicates that the company generates sufficient cash from its core business activities to cover expenses, reinvest in its business, and pursue growth opportunities. Positive cash flow from operations is a positive sign of a company’s financial health.

Cash Flow from Investing

Tata Technologies’ cash flow from investing has been negative recently due to heavy investments in new growth opportunities. However, as these investments generate returns, the company’s cash flow is expected to turn positive. It signifies the company’s commitment to long-term growth and focus on expanding its capabilities and market presence.

Cash Flow from Financing

Tata Technologies has experienced positive cash flow from financing, indicating successful fundraising through debt to support its growth initiatives. As the company continues to reduce its debt levels, the cash flow from financing is expected to decline. Managing debt levels is essential to maintain financial stability.

Net Cash Flow

Tata Technologies has achieved positive net cash flow in recent years. It implies that the company has been able to generate more cash from its operations than it has been spending on investing and financing activities. Positive net cash flow strengthens the company’s financial position and allows it to build cash reserves for future investments and strategic endeavours.

Key Takeaways from the Cash Flow Statement Analysis

Here are some key takeaways from the cash flow statement analysis of Tata Technologies:

- Tata Technologies generates substantial cash flow, indicating its operational efficiency.

- This tech giant is actively investing in growth opportunities focusing on long-term success.

- Positive net cash flow demonstrates the company’s ability to build cash reserves and pursue strategic initiatives.

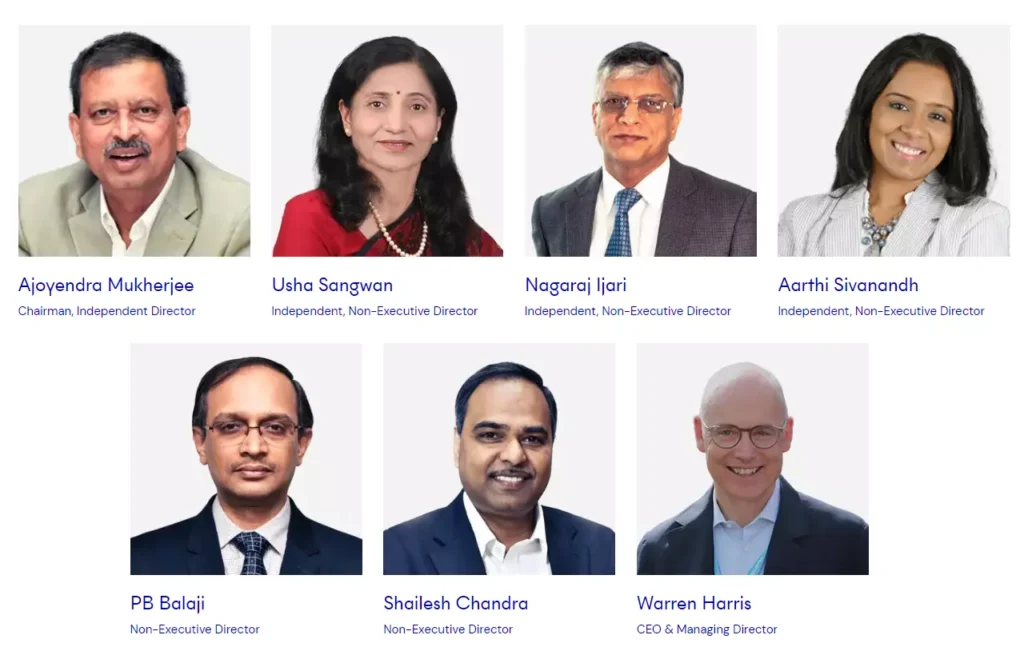

Key Members of the Tata Technologies Management Team

Tata Technologies benefits from a solid and experienced management team that drives the company’s growth and success.

Some key members of the Tata Technologies management team include:

Ajoyendra Mukherjee: Chairman and Independent Director

Ajoyendra Mukherjee holds the prestigious position of Chairman and Independent Director at Tata Technologies. With a bachelor’s degree in engineering from the renowned Birla Institute of Technology and Science, his expertise lies in electrical and electronics. Having spent nearly four decades at Tata Consultancy Services Limited, Mukherjee held several key positions, including the head of business operations in Eastern India, the Middle East, and Africa. His remarkable contributions extend to roles such as the global head of CSR function, global head of energy and utility practice, executive vice president and global head of human resources.

Warren Kevin Harris: CEO and Managing Director

Warren Kevin Harris, the Chief Executive Officer and Managing Director of Tata Technologies is a distinguished leader with an impressive educational background. Holding a bachelor’s degree in engineering from the University of Wales (U.K.), Institute of Science and Technology, he also earned a doctorate in philosophy (honoris causa) from Amity University, Uttar Pradesh. Harris further honed his skills through the advanced management program at Harvard Business School. As a chartered mechanical engineer registered with the Institution of Mechanical Engineers, he brings knowledge and experience. Notably, Harris was awarded the Malcolm Baldridge National Quality Award for his outstanding services to the nation as a member of the Board of Oversees of the Malcolm Baldrige National Quality Award.

Usha Sangwan: Independent Director

Usha Sangwan serves as an Independent Director at Tata Technologies. Her educational journey includes a bachelor’s degree and a master’s in arts, specializing in economics, from Panjab University. She also holds a post-graduate human resource management diploma from Indira Gandhi National Open University. Sangwan’s achievements include a licentiate examination (life branch) from the Federation of Insurance Institutes. Before joining Tata Technologies, she was managing director at the Life Insurance Corporation of India, showcasing her exceptional leadership and expertise.

Aarthi Sivanandh: Independent Director

As an Independent Director at Tata Technologies, Aarthi Sivanandh brings a unique blend of commerce and law expertise. She holds a bachelor’s degree in commerce from the University of Madras and a bachelor’s degree in law from the Tamil Nadu Dr Ambedkar Law University. Sivananda further deepened her legal knowledge through a master’s degree in law from Tulane University. Enrolled with the Bar Council of the state of Tamil Nadu, she currently holds the position of equity partner with J. Sagar Associates, adding significant value to the board of Tata Technologies.

Nagaraj Ijari: Independent Director

Nagaraj Ijari, an Independent Director at Tata Technologies, combines technical and management skills. Holding a bachelor’s degree in technology, specializing in textiles from Bangalore University, he further enhanced his expertise through the advanced management program at Harvard Business School. Ijari’s prior experience includes being a senior programmer at Gherzi Eastern Limited, a systems engineer at Mafatlal Consultancy Services (India) Limited, and head of the business unit at Tata Consultancy Services. With his diverse background, Ijari contributes valuable insights to the company’s strategic decisions.

Pathamadai Balachandran Balaji: Non-Executive Director

Pathamadai Balachandran Balaji serves as a Non-Executive Director at Tata Technologies. Holds a bachelor’s degree in mechanical engineering (M.E.) from the IIT (Indian Institute of Technology), Madras (Chennai), and a post-graduate diploma in business management from the IIM (Indian Institute of Management), Kolkata, Balaji, brings solid financial insight to the company. He currently holds the position of president and chief financial officer of Tata Motors group. Balaji’s previous role as an executive director and chief financial officer of Hindustan Unilever Limited has further enriched his understanding of the industry.

Shailesh Chandra: Non-Executive Director

Shailesh Chandra, a Non-Executive Director at Tata Technologies, has a mechanical engineering and business administration background. He earned his bachelor’s degree in technology from Banaras Hindu University and completed an executive master’s in business administration from S.P. Jain Institute of Management and Research. Before joining Tata Technologies, Chandra held the head of strategy and business transformation position at Tata Motors Limited, the company’s promoter. He is the MD (managing director) of Tata Motors Passenger Vehicle Limited and Tata Passenger Electric Mobility Limited)d, showcasing his valuable contributions to the organization.

These key Tata Technologies management team members contribute to the company’s strategic vision, operational excellence, and ability to drive innovation in the engineering and product development services industry.

Tata Technologies Products

Tata Technologies offers a diverse range of critical products that cater to the needs of its clients. Some of its essential products include:

Digital Enterprise Solutions (DES): Tata Technologies’ DES is designed to help manufacturing customers identify and deploy technologies, tools, and solutions to manufacture, service, and realize better products.

Engineering and Product Development Services: Tata Technologies provides comprehensive engineering and product development services to automotive, defence, and aerospace customers.

Digital Manufacturing Solutions: Tata Technologies’ digital manufacturing solutions assist customers in improving their manufacturing processes and operations.

Simulation and Testing Services: Tata Technologies’ simulation and testing services enable customers to test their products and processes in a virtual environment.

Training and Consulting Services: Tata Technologies’ training and consulting services help customers enhance their engineering and product development capabilities.

The comprehensive range of products offered by Tata Technologies helps its clients improve efficiency, reduce costs, increase quality, and enhance innovation in their respective industries.

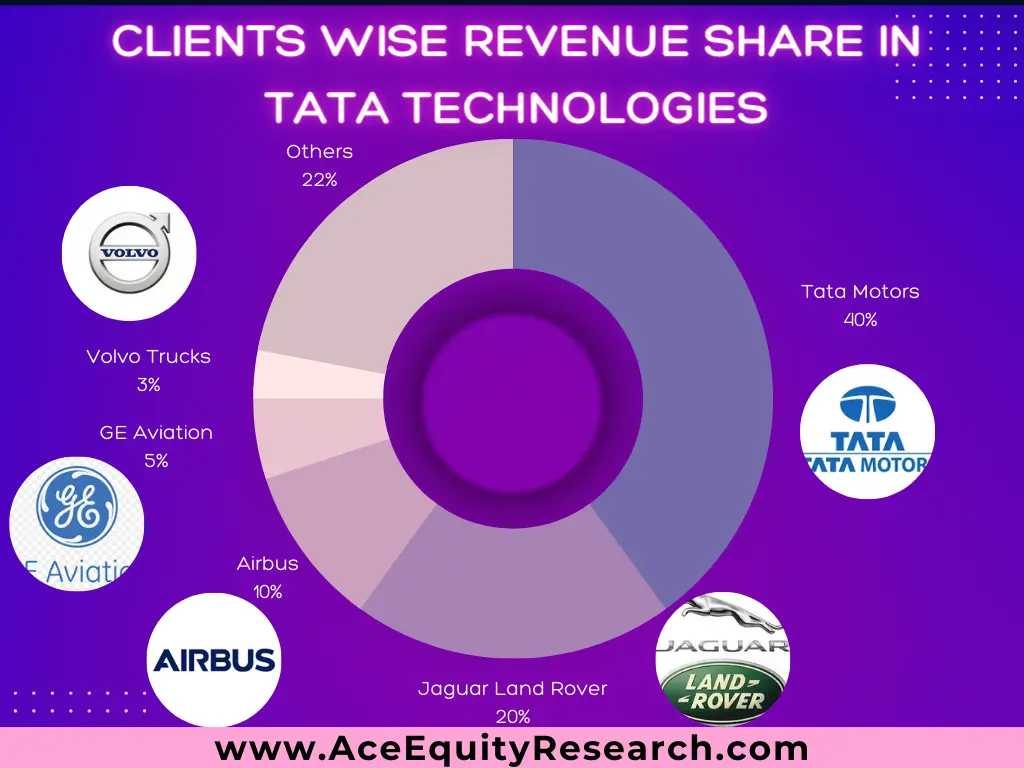

Tata Technologies Clients

Tata Technologies has a diverse portfolio of clients, including some of the industry’s key players. Here are a few notable clients of Tata Technologies:

Tata Motors: As Tata Technologies’ most significant customer, Tata Motors receives engineering and product development services across its automotive businesses, including passenger cars, commercial vehicles, and electric vehicles.

Jaguar Land Rover: Tata Technologies is a crucial supplier to Jaguar Land Rover, providing engineering and product development services for their luxury cars and SUVs.

Airbus: Tata Technologies is a pivotal supplier to Airbus, offering engineering and product development services for their commercial aircraft, including the A320 and A350 families.

GE Aviation: Tata Technologies is a crucial supplier to GE Aviation, providing engineering and product development services for their aircraft engines, including the GE90 and the GEnx.

Volvo Trucks: Tata Technologies is a crucial supplier to Volvo Trucks, offering engineering and product development services for their range of trucks, including the Volvo FH and the Volvo FM.

These are just a few examples of Tata Technologies’ key clients. The company has established a strong presence in the automotive, aerospace, and defence industries by collaborating with industry leaders.

Benefits of Tata Technologies to JLR and Tata Motors

Tata Technologies substantially benefits JLR and Tata Motors through its extensive range of services. Here are some key benefits that Tata Technologies provides to these companies:

Reduced Costs: Tata Technologies helps JLR and Tata Motors reduce costs by offering engineering and product development services at a lower price than they could achieve internally.

Improved Quality: Tata Technologies enhances the quality of vehicles for JLR and Tata Motors through its expertise in design, manufacturing, and testing, thereby ensuring superior product performance.

Faster Time to Market: By leveraging efficient engineering and product development services, Tata Technologies enables JLR and Tata Motors to bring new vehicles to market, reducing time-to-market quickly.

Access to New Technologies: Tata Technologies has cutting-edge technologies such as AI (artificial intelligence), 3D printing, and augmented reality. These technologies enable JLR and Tata Motors to enhance their design, manufacturing, and testing processes.

Global Reach: With a worldwide presence in over 20 countries, Tata Technologies provides JLR and Tata Motors access to a diverse talent pool, facilitating worldwide collaboration and cost-effective solutions.

Partnerships: Tata Technologies has established partnerships with major players in the automotive and aerospace industries, enabling JLR and Tata Motors to access new technologies and markets.

Overall, Tata Technologies is pivotal in helping JLR and Tata Motors achieve cost reductions, quality improvements, faster time-to-market, access to new technologies, global expansion, and collaborative partnerships.

Tata Technologies Future Plans

Tata Technologies has ambitious plans for the future. Some of them are:

Expanding Global Reach: Tata Technologies aims to expand its worldwide presence by opening new offices in key markets such as Southeast Asia and China. This global expansion will enable the company to reach new customers and drive revenue growth.

Investing in New Technologies: Tata Technologies is committed to investing in futuristic technologies such as Artificial Intelligence (AI) and augmented reality. These investments will help the company outperform competitors and offer more advanced services to its clients.

Focusing on Growth Areas: Tata Technologies intends to focus on growth areas such as the electric vehicle and aerospace industries. By capitalizing on the growth of these industries, the company aims to strengthen its position as a market leader.

Strengthening Partnerships: Tata Technologies plans to enhance its partnerships with fundamental automotive, aerospace, and defence players. These strategic partnerships will facilitate resource sharing, expertise exchange, and acquiring new projects.

Through these plans, Tata Technologies aims to sustain its growth trajectory, expand its market presence, and continue delivering innovative solutions to its clients.

Tata Technologies Competitive Advantages (MOAT)

Tata Technologies enjoys several competitive advantages contributing to its market success. These advantages include:

Strong Brand Reputation: Tata Technologies has built a strong brand reputation in the engineering and product development services industry. This reputation helps attract new clients and win projects.

Global Reach: With operations in over 27 countries, Tata Technologies has established a global presence. This broad customer base allows the company to tap into new markets and diversify its revenue streams.

Deep Expertise: Tata Technologies has deep expertise in engineering and product development. This expertise enables the company to deliver high-quality client services, fostering long-term partnerships.

Strong Management Team: Tata Technologies boasts an experienced and solid management team with a proven track record of success. This competent leadership ensures the effective execution of the company’s strategies and drives growth.

Investment in New Technologies: Tata Technologies consistently invests in new-age technologies, such as augmented reality and artificial intelligence. This investment keeps the company at the forefront of innovation and positions it ahead of its competitors.

These competitive advantages, collectively known as the company’s MOAT (moat), make it challenging for competitors to enter and compete with Tata Technologies.

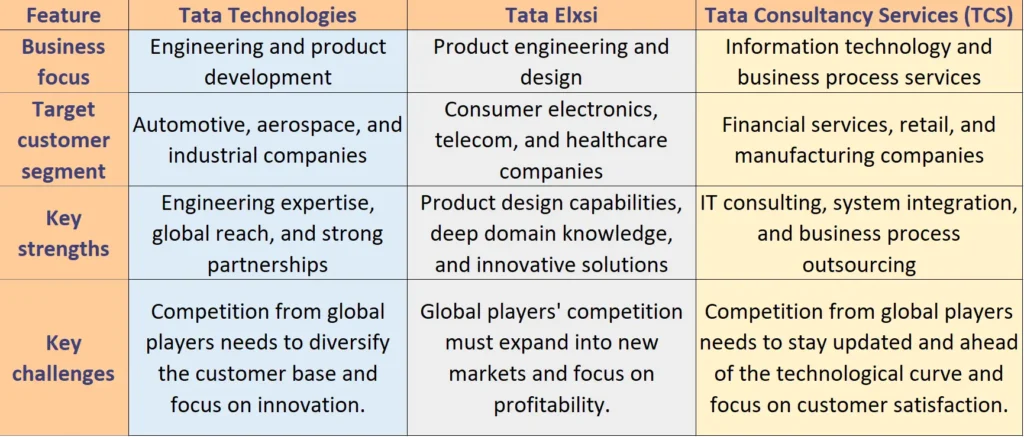

Critical Differences between Tata Technologies, Tata Elxsi, and Tata Consultancy Services

Tata Technologies, Tata Elxsi, and Tata Consultancy Services are all part of the Tata Group, but they cater to different industries and provide specific services. Understanding their differences is crucial for investors looking to make informed decisions.

Industry Focus

Tata Technologies primarily focuses on the automotive, industrial, and aerospace industries. With a strong track record of innovation, the company is renowned for its expertise in 3D printing, augmented reality, and artificial intelligence. On the other hand, Tata Elxsi concentrates on the electronics, semiconductor, and telecommunications industries while also serving clients in the automotive and aerospace sectors. Tata Consultancy Services (TCS) specializes in IT consulting, system integration, and business process outsourcing and mainly serves the financial services, retail, and manufacturing industries.

Service Offerings

Tata Technologies offers its clients a comprehensive range of engineering and design services. These services encompass various aspects, including product development, manufacturing support, and engineering research. Tata Elxsi, on the other hand, provides product engineering and design services, leveraging its deep domain knowledge to deliver innovative solutions. TCS offers many IT and consulting services, assisting organizations in their digital transformation journeys.

Geographic Focus

Tata Technologies has a strong focus on India and the Asia-Pacific region. It has established a robust presence in these markets and leverages its local expertise to cater to clients’ needs in this region. Tata Elxsi, in contrast, has a strong presence in the Americas and Europe, enabling it to serve clients in these geographies effectively. TCS has a global focus and serves clients across all regions, ensuring a widespread customer base.

Tata Technologies’ Main Competitors

To better understand Tata Technologies’ position in the market, let’s look at some of its main competitors.

Competition in India Landscape

- KPIT Technologies: KPIT Technologies is an Indian multinational engineering and product development services company. It provides product design, development, and manufacturing services to some of the world’s leading companies.

- Mahindra Engineering: Mahindra Engineering, a subsidiary of the Mahindra Group, offers engineering and product development services, including design, manufacturing, and testing.

- Tech Mahindra: Tech Mahindra, another Mahindra Group subsidiary, specializes in information technology and business process services. It focuses on the engineering and manufacturing sectors and offers various engineering and product development services.

- L&T Technology Services: A key subsidiary of Larsen & Toubro, “L&T Technology Services” provides engineering and product development services, including design, manufacturing, and testing.

- Wipro: Wipro, a global information technology company, offers engineering and product development services with a specific emphasis on the automotive and aerospace industries. It has key partnerships with major players in these sectors.

- Infosys: Infosys, one of India’s largest multinational IT companies, provides IT services, including engineering and product development, to leading companies worldwide.

- Geometric: Geometric is an Indian multinational engineering and product development services company. It offers product design, development, and manufacturing services to prominent organizations.

Competition in International Landscape

- CGI: CGI is a global information technology company focusing on the automotive and aerospace industries. It has strategic partnerships with major players and offers engineering and product development services.

- Dassault Systèmes: Dassault Systèmes, a French multinational software company, specializes in 3D design, engineering, and manufacturing software. It serves as a leader in the engineering and product development services industry.

- Siemens: Siemens, a German multinational conglomerate, provides various products and services, including engineering and product development services. It has a strong presence in the industry and serves leading companies worldwide.

These competitors challenge Tata Technologies by providing similar product development and engineering services to the automotive, aerospace, and defence industries. Tata Technologies must continue investing in new technologies and expanding its global reach to stay ahead.

Tata Technologies’ Advantages and Challenges

Tata Technologies boasts several advantages that contribute to its success. The company has a strong brand reputation, enjoys a global reach, and possesses engineering and product development expertise. These factors position Tata Technologies as a preferred partner for organizations seeking innovative solutions. However, the company faces challenges, particularly from international players like Dassault Systèmes and Siemens, who are vying for market dominance. To maintain a competitive edge, Tata Technologies must continue investing in new technologies and expanding its global footprint.

Risk Factors to Consider

Before investing in Tata Technologies’ IPO, it is essential to consider the risk factors associated with the company. While Tata Technologies has a strong track record of profitability, certain risks could impact its business:

- Dependency on a few key clients: Tata Technologies relies heavily on key clients such as Tata Motors, Airbus, and GE Aviation. Any financial difficulties these clients face could adversely affect Tata Technologies’ business.

- Concentration in the automotive sector: Tata Technologies’ revenue is concentrated in the automotive industry. Any downturn in the sector could significantly impact the company’s financial performance.

- Increased competition: Tata Technologies faces rising competition from global players like Siemens and Dassault Systèmes. This competition could put pressure on the company’s margins.

- New technologies: The engineering and product development services industry is evolving rapidly by introducing technologies like artificial intelligence and augmented reality. Tata Technologies must invest in these areas to stay ahead of the competition.

- Geopolitical risks: Tata Technologies operates in several countries, exposing it to geopolitical risks that could disrupt its operations.

Investors considering Tata Technologies’ IPO should carefully evaluate these risk factors and read the Draft Red Herring Prospectus (DRHP) to understand the company’s financial profile better.

Tata Technologies in Accelerating the Future of Mobility

Tata Technologies plays a vital role in shaping the future of mobility by partnering with leading companies in the industry. The company’s expertise and services enhance product performance, manufacturing efficiency, customer experience, and digital transformation.

Product Engineering and Design

Tata Technologies excels in providing mobility manufacturers with comprehensive product engineering and design solutions. The company leverages its deep understanding of mobility products and processes from ideation to production to help clients create innovative and competitive offerings. Tata Technologies supports manufacturers in delivering exceptional products by focusing on performance optimization, reliability enhancement, and cost-effectiveness.

Manufacturing Engineering

Efficient manufacturing is crucial for the success of mobility manufacturers, and Tata Technologies assists in optimizing their manufacturing operations. The company’s expertise in manufacturing engineering spans various areas, including plant design, layout optimization, process improvement, and quality control. Tata Technologies helps manufacturers reduce costs, improve productivity, and achieve higher operational excellence through its services.

Customer Experience

Tata Technologies recognizes the significance of a positive customer experience and offers services to enhance this aspect for mobility manufacturers. By providing comprehensive product information, training programs, and efficient support systems, the company enables manufacturers to deliver exceptional customer experiences. This focus on customer satisfaction contributes to brand loyalty and market growth.

Digital Transformation

In today’s digital age, embracing digital technologies is essential for mobility manufacturers to stay competitive. Tata Technologies assists clients in their digital transformation journeys by leveraging its expertise in Industry 4.0, IoT, and data analytics. By adopting these technologies, manufacturers can streamline operations, improve efficiency, and gain a competitive edge.

Successful Case Studies

Tata Technologies has a proven track record of successful collaborations with leading mobility manufacturers. Some notable case studies include:

- Partnership with Tata Motors: In 2018, Tata Technologies collaborated with Tata Motors to develop a new electric vehicle platform called the Ziptron. This platform aimed to provide improved efficiency and cost-effectiveness compared to previous offerings. Tata Technologies’ engineering capabilities and manufacturing expertise were crucial in developing the Ziptron platform.

- Fuel Efficiency Enhancement with Jaguar Land Rover: In 2019, Tata Technologies worked closely with Jaguar Land Rover to enhance the fuel efficiency of their vehicles. Through collaborative efforts, Tata Technologies’ engineers identified and implemented design and manufacturing changes that significantly improved the fuel efficiency of Jaguar Land Rover’s vehicles.

- Development of an Autonomous Vehicle Platform with Volvo: In 2020, Tata Technologies partnered with Volvo to develop a new autonomous vehicle platform. The objective was to create a platform that prioritizes safety and reliability. Tata Technologies’ engineering prowess and manufacturing capabilities were instrumental in the successful development of the forum.

These case studies highlight Tata Technologies’ ability to drive innovation, improve performance, and contribute to the growth of its clients in the mobility sector.

Tata Technologies Powers the Future of Electric Vehicles

As the world moves toward a more sustainable future, electric vehicles (EVs) have gained significant attention. Tata Technologies actively contributes to the EV segment by providing manufacturers with comprehensive engineering and design services. The company’s expertise in EVs encompasses product development, manufacturing optimization, customer experience enhancement, and digital transformation.

Product Engineering and Design for EVs

Tata Technologies supports EV manufacturers in all aspects of product development, from concept to production. The company helps manufacturers improve performance, reliability, and cost-effectiveness by profoundly understanding the intricacies of EV products and processes. Tata Technologies’ expertise covers battery technology, powertrain optimization, lightweight, and aerodynamics.

Manufacturing Engineering for EVs

Efficient manufacturing is critical for the success of EV manufacturers, and Tata Technologies aids them in optimizing their manufacturing operations. The company’s services in manufacturing engineering encompass plant design, layout optimization, process efficiency, and quality control. By leveraging advanced manufacturing techniques and Industry 4.0 principles, Tata Technologies enables EV manufacturers to achieve high-quality production while reducing costs.

Enhancing Customer Experience in the EV Segment

Tata Technologies understands the importance of a positive customer experience in the EV industry and supports manufacturers. By providing comprehensive product information, training programs, and responsive support systems, the company helps EV manufacturers create a rewarding customer ownership experience. This customer-centric approach fosters brand loyalty and contributes to market success.

Driving Digital Transformation in EV Manufacturing

Manufacturers must embrace digital transformation to stay competitive in the rapidly evolving EV industry. Tata Technologies assists EV manufacturers in this transition by providing expertise in digital technologies and Industry 4.0 practices. Manufacturers can optimize their processes, improve supply chain management, and enhance overall operational efficiency by adopting digital tools.

Notable Case Studies in the EV Segment

Some notable case studies that demonstrate Tata Technologies’ capabilities in the EV segment include:

- Collaboration with Tata Motors: In 2018, Tata Technologies collaborated with Tata Motors to develop the Ziptron platform for electric vehicles. This platform aimed to deliver enhanced efficiency and cost-effectiveness compared to previous offerings. Tata Technologies’ engineering prowess and manufacturing capabilities played a significant role in successfully developing the Ziptron platform.

- Range Improvement with Mahindra Electric: In 2019, Tata Technologies collaborated with Mahindra Electric to improve the range of their e-Verito electric car. Tata Technologies’ engineers worked closely with Mahindra Electric to identify and implement advancements in battery technology that significantly improved the car’s capacity and range.

- Development of Electric Bus Platform with Volvo: In 2020, Tata Technologies partnered with Volvo to develop a new electric bus platform. This platform focuses on safety and reliability while offering superior performance. Tata Technologies’ engineering expertise and manufacturing capabilities contributed to the successful development of the forum.

These case studies highlight Tata Technologies’ commitment to driving innovation, improving performance, and supporting the growth of EV manufacturers.

Tata Technologies in Aerospace Engineering

Tata Technologies has established itself as a leading engineering and design company in the aerospace industry. By leveraging its extensive knowledge and experience, Tata Technologies offers a range of services that cater to the specific needs of aerospace manufacturers.

– Product Engineering and Design

With a deep understanding of aerospace products and processes, Tata Technologies collaborates with manufacturers to enhance their product performance, reliability, and cost-effectiveness. From initial concept development to the final production, the company supports aerospace manufacturers in every step of the product engineering and design process.

– Manufacturing Engineering

Tata Technologies assists aerospace manufacturers in optimizing their manufacturing operations. By providing expertise in plant design, layout, process optimization, and quality control, the company helps manufacturers streamline their production procedures, improve efficiency, and reduce costs.

– Customer Experience

Recognizing the importance of customer experience in the aerospace industry, Tata Technologies focuses on enhancing the overall satisfaction of end-users. The company offers valuable support regarding product information, training, and customer service, ensuring a positive and rewarding customer experience.

– Maintenance, Repair, and Overhaul (MRO)

Tata Technologies boasts an extensive network of facilities and a team of experienced engineers dedicated to providing maintenance, repair, and refurbishment services for a wide range of aerospace products. The company delivers comprehensive MRO solutions to aerospace manufacturers, from component repair to aircraft overhaul and engine maintenance.

– Case Studies in Aerospace Engineering

Tata Technologies has collaborated with renowned aerospace manufacturers, including Airbus, Boeing, and Safran, to achieve remarkable outcomes. Here are a few noteworthy case studies that demonstrate the company’s capabilities:

- In 2018, Tata Technologies partnered with Airbus to develop a more fuel-efficient wing design for the A320 aircraft. The collaboration resulted in a wing design that reduced emissions and enhanced fuel efficiency.

- Tata Technologies collaborated with Boeing in 2019 to optimize the manufacturing process of their 737 aircraft. Through the implementation of new manufacturing processes, productivity was significantly improved.

- In 2020, Tata Technologies supported Safran in developing a new engine for their LEAP aircraft family. The innovative engine design achieved higher fuel efficiency and reduced emissions.

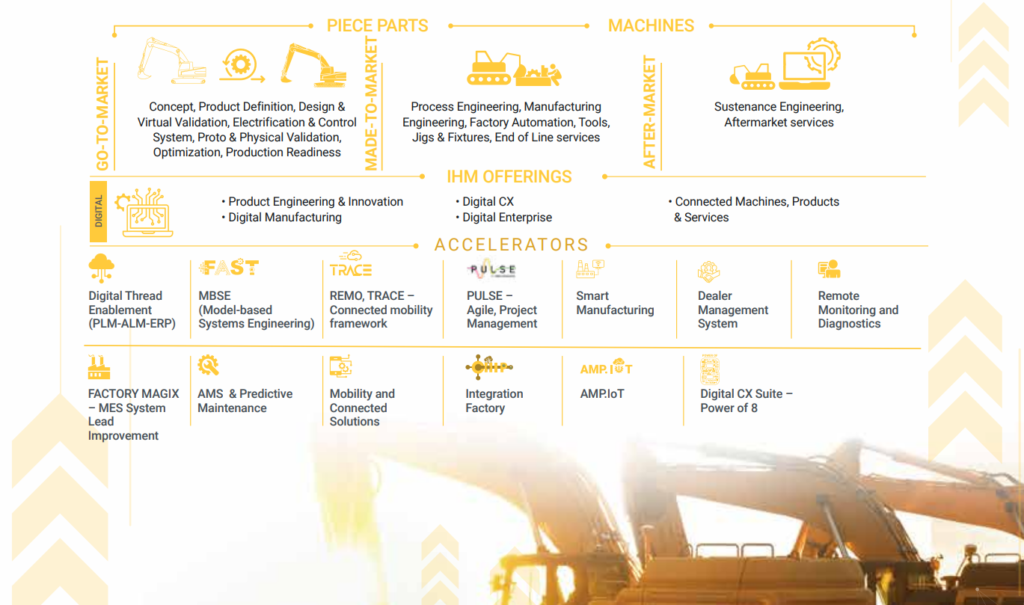

Tata Technologies in Industrial Heavy Machinery

In addition to its aerospace engineering expertise, Tata Technologies provides services to the heavy industrial machinery (IHM) segment. Let’s explore how Tata Technologies contributes to the IHM industry.

– Product Engineering and Design

Tata Technologies assists IHM manufacturers in developing high-quality products that meet industry standards. The company helps manufacturers enhance performance, reliability, and cost-effectiveness by leveraging their in-depth understanding of IHM products and processes.

– Manufacturing Engineering

Tata Technologies collaborates with IHM manufacturers to optimize their manufacturing operations. By leveraging advanced techniques in plant design, layout, process optimization, and quality control, the company enables manufacturers to improve efficiency, productivity, and overall competitiveness.

– Customer Experience

Tata Technologies focuses on enhancing the customer experience in the IHM industry. By providing comprehensive support in product information, training, and customer service, the company helps manufacturers create a positive and appealing experience for their customers.

– Case Studies in Industrial Heavy Machinery

Tata Technologies has partnered with leading IHM manufacturers to achieve significant improvements. Here are a few case studies that showcase the company’s capabilities:

- Tata Technologies collaborated with Hitachi Construction Machinery to develop a new backhoe loader that exhibited enhanced reliability, efficiency, and productivity.

- The company worked with Caterpillar to improve their excavators’ fuel efficiency by implementing design and manufacturing changes.

- Tata Technologies helped Komatsu optimize the manufacturing process and identify cost-saving opportunities for dump trucks.

Conclusion

Tata Technologies, a multinational engineering and product development services company, has a rich history and diverse offerings. The company’s global presence serves clients across multiple industries, including automotive, aerospace, and defence.

Tata Technologies plays a significant role in shaping the future of mobility by providing comprehensive engineering and design services, enabling digital transformation, and supporting the growth of electric vehicles. As Tata Technologies prepares for its Initial Public Offering (IPO), potential investors should consider its strong track record, strategic acquisitions, and pivotal role in the industry’s future. Investing in Tata Technologies’ IPO represents an opportunity to support a company with a proven track record and vast experience in engineering and design services.

Before making investment decisions, conducting thorough research, considering market conditions, and consulting with financial advisors are essential.

Frequently Asked Questions (FAQs)

What is Tata Technologies’ primary focus?

Tata Technologies primarily focuses on the automotive and aerospace industries. However, it also serves customers in other sectors, such as industrial and manufacturing.

Who are the main competitors of Tata Technologies?

Tata Technologies’ main competitors include KPIT Technologies, Mahindra Engineering, Tech Mahindra, L&T Technology Services, Wipro, Infosys, CGI, Dassault Systèmes, and Siemens.

What are the risk factors associated with investing in Tata Technologies?

Some risk factors to consider when investing in Tata Technologies include dependency on key clients, concentration in the automotive sector, increased competition, technological advancements, and geopolitical risks.

How does Tata Technologies differentiate itself from Tata Elxsi and Tata Consultancy Services?

While Tata Technologies, Tata Elxsi, and Tata Consultancy Services are all part of the Tata Group, they have different industry focuses and service offerings. Tata Technologies specializes in engineering and product development for the automotive and aerospace sectors. Tata Elxsi focuses on consumer electronics and telecom, and Tata Consultancy Services provides IT and consulting services.

How can I learn more about Tata Technologies’ IPO?

For more detailed information about Tata Technologies’ IPO, it is recommended to read the Draft Red Herring Prospectus (DRHP) available from the company and consult with financial advisors.

How does Tata Technologies help reduce costs for its clients?

Tata Technologies offers engineering and product development services at a lower price than its clients could achieve internally, helping them reduce costs while maintaining quality.

What are some key benefits of Tata Technologies to JLR and Tata Motors?

Some benefits of Tata Technologies to JLR and Tata Motors include reduced costs, improved quality, faster time-to-market, access to new technologies, global reach, and strategic partnerships.

How does Tata Technologies contribute to innovation?

Tata Technologies provides its clients access to new technologies and expertise, enabling them to drive innovation in their products and processes.

What are Tata Technologies’ plans for expansion?

Tata Technologies plans to expand its global reach by opening new offices in key markets such as China and Southeast Asia, allowing the company to reach new customers and drive growth.

What are the competitive advantages of Tata Technologies?

Tata Technologies has a strong brand reputation, global reach, deep expertise, and a competent management team. Additionally, the company invests in new technologies to stay ahead of the competition. These factors make it difficult for competitors to enter the market and compete with Tata Technologies.

How can Tata Technologies help aerospace manufacturers improve their products?

Tata Technologies offers product engineering and design services that assist aerospace manufacturers in enhancing product performance, reliability, and cost-effectiveness. The company’s expertise covers all stages of product development, from concept to production.

What is Tata Technologies’ track record in the aerospace engineering segment?

Tata Technologies has a strong track record of success in the aerospace engineering segment. The company has partnered with leading manufacturers like Airbus, Boeing, and Safran, helping them improve their products, reduce costs, and grow their businesses.

Which leading aerospace manufacturers has Tata Technologies worked with?

Tata Technologies has collaborated with renowned aerospace manufacturers, including Airbus, Boeing, and Safran. These partnerships have significantly improved product design, manufacturing processes, and overall performance.

How did Tata Technologies contribute to Airbus’ A320 wing design?

Tata Technologies partnered with Airbus to develop a new wing design for the A320 aircraft. The collaboration focused on improving fuel efficiency and reducing emissions, resulting in a wing design that met these objectives.

What are Tata Technologies’ capabilities in the industrial heavy machinery segment?

Tata Technologies provides product engineering and design services to industrial heavy machinery (IHM) manufacturers, helping them enhance product performance, reliability, and cost-effectiveness. Additionally, the company assists in manufacturing process optimization and improving the overall customer experience.

What is Tata Technologies IPO?

Tata Technologies IPO is an initial public offering of shares by Tata Technologies, a global engineering and product development services company. The IPO is expected to raise ₹5,000-6,000 crores.

When will Tata Technologies IPO be launched?

The Tata Technologies IPO is expected to be launched in July-August 2023.

How many shares will be offered in the Tata Technologies IPO?

The Tata Technologies IPO will offer 95,708,984 equity shares with a face value of ₹ two each.

What is the expected price range for the Tata Technologies IPO?

The expected price range for the Tata Technologies IPO is ₹500-550 per share.

How can I apply for the Tata Technologies IPO?

You can apply for the Tata Technologies IPO through a stockbroker. You will need to have a demat account and a trading account with a stockbroker.

What risks are associated with investing in the Tata Technologies IPO?

There are always risks associated with investing in any IPO. The risks associated with investing in the Tata Technologies IPO include the company’s financial performance meeting expectations, changes in the regulatory environment affecting the business, and short-term stock price volatility.

Should I invest in the Tata Technologies IPO?

Whether or not you should invest in the Tata Technologies IPO is a decision you should make after carefully considering the risks and potential rewards. It is recommended to consult with a financial advisor before making any investment decisions.

What is Tata Technologies?

Tata Technologies is a prominent global engineering and product development services company headquartered in Pune, India. It is a part of the Tata Group, one of the largest conglomerates in India.

What does Tata Technologies do?

Tata Technologies provides engineering and product development services to various industries, including automotive, aerospace, and defence. Its services range from digital enterprise solutions and engineering to simulation, testing, and training.

What are Tata Technologies’ key clients?

Tata Technologies’ key clients include Tata Motors, Jaguar Land Rover, Airbus, GE Aviation, and Volvo Trucks.

What are Tata Technologies’ plans?

Tata Technologies is focused on growth in the digital engineering and manufacturing space. The company invests in new technologies and plans to expand its global reach by opening new offices in key markets.

What are the risks associated with investing in Tata Technologies?

Investing in Tata Technologies comes with risks, such as the company’s financial performance meeting expectations, changes in the regulatory environment, and short-term stock price volatility. It is essential to consider these factors before making any investment decisions.

Should I invest in Tata Technologies?

Investing in Tata Technologies should be based on carefully considering the risks and potential rewards. Consulting with a financial advisor can provide valuable insights to help make an informed investment decision.

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory. This is not an investment advisory. The blog is for information purposes only. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Past performance is not indicative of future returns. Please consider your specific investment requirements, risk tolerance, goal, time frame, risk and reward balance, and the cost associated with the investment before choosing a fund or designing a portfolio that suits your needs. The performance and returns of any investment portfolio can neither be predicted nor guaranteed.

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Do conduct your research along with financial advisors before making any investment decisions. Ace Equity Research and the team are not accountable for the investment views provided in the article.