Investing in index funds has become increasingly popular due to their low costs, diversification benefits, and ease of access. As an investor, it’s essential to understand the metrics that gauge the performance of these funds. Tracking error and tracking difference are key measurements in evaluating index funds. This article will explore the difference between tracking error and tracking Difference, their significance, and how they impact your investment returns.

I. Introduction

A. Overview of Index Funds Index funds are investment instruments designed to mimic the performance of a precise market index, such as the S&P 500 or the FTSE 100. These funds offer diversification across various securities, exposing investors to multiple companies within a particular market segment.

B. Importance of Tracking Error and Tracking Difference Tracking error and tracking difference are essential metrics for investors evaluating the performance of index funds. These measures provide insights into how closely the fund’s returns align with the index it aims to replicate. By understanding these metrics, investors can assess the fund’s ability to deliver the desired returns.

C. Brief Mention of Formulas for Tracking Error and Tracking Difference Tracking error and tracking difference are calculated using specific formulas. These formulas consider the returns of the index and the fund, providing a quantitative measure of how closely the fund tracks the index. The following segments will detail the formulas for tracking error and tracking Difference.

II. Tracking Error

A. Definition and Explanation of Tracking Error Tracking error measures the consistency of an index fund’s returns compared to the benchmark index it tracks. It quantifies the standard deviation of the difference between the fund’s and index’s returns over a specific period. In simple terms, tracking error reflects how closely the fund’s performance matches the index’s performance.

B. Importance of Tracking Error in Evaluating Index Fund Performance Tracking error is an important metric as it indicates the fund’s ability to accurately replicate the index’s returns. A lower tracking error suggests higher accuracy in tracking the index. Investors typically prefer index funds with insufficient tracking error, implying that the fund closely mirrors the index’s performance.

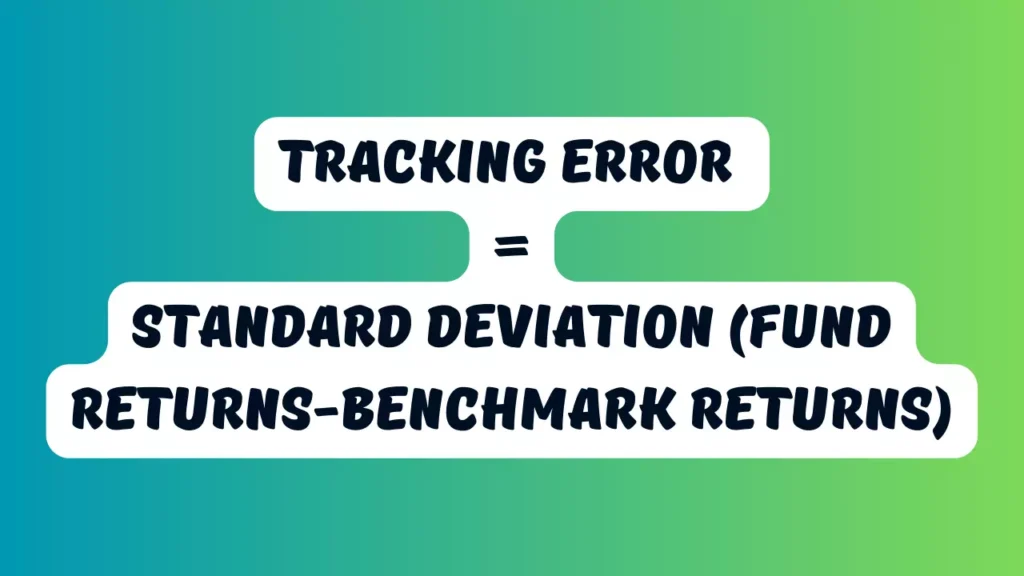

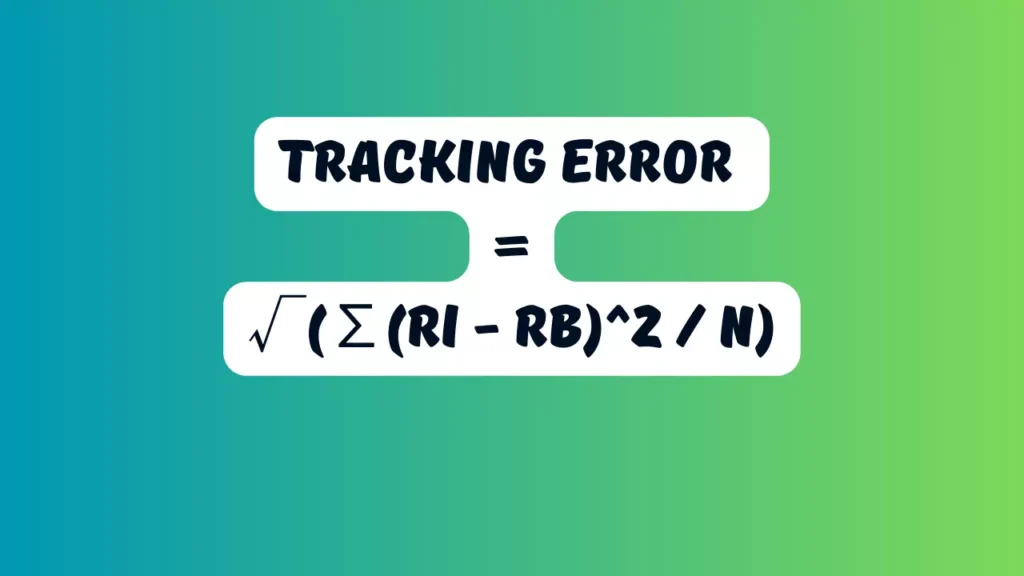

C. Formula for Tracking Error The formula for tracking error involves calculating the standard deviation of the Difference between the fund’s and index’s returns. It can be calculated using the subsequent procedure:

Tracking Error = Standard Deviation (Fund Returns-Benchmark Returns)

or

Tracking Error = √(∑(Ri – Rb)^2 / N)

Where:

- Ri represents the returns of the fund

- Rb represents the returns of the benchmark index

- N represents the number of observations

D. Example Illustrating Tracking Error Calculation Let’s consider an example to understand the calculation of tracking error better. Suppose an index fund’s monthly returns over a year are as follows:

| Month | Fund Returns (%) | Index Returns (%) |

| Jan | 0.8 | 1.2 |

| Feb | 1.1 | 0.9 |

| Mar | 0.9 | 1.0 |

| Apr | 0.7 | 0.8 |

| May | 1.2 | 1.1 |

| Jun | 1.0 | 0.9 |

| Jul | 0.8 | 0.7 |

| Aug | 1.1 | 1.2 |

| Sep | 0.9 | 0.8 |

| Oct | 1.0 | 0.9 |

| Nov | 1.2 | 1.1 |

| Dec | 0.8 | 0.7 |

To calculate the tracking error for this index fund, we first need to calculate the Difference between the fund returns and the index returns for each month:

| Month | Difference (%) |

| Jan | -0.4 |

| Feb | 0.2 |

| Mar | -0.1 |

| Apr | -0.1 |

| May | 0.1 |

| Jun | 0.1 |

| Jul | 0.1 |

| Aug | -0.1 |

| Sep | 0.1 |

| Oct | 0.1 |

| Nov | 0.1 |

| Dec | 0.1 |

Next, we square each difference and sum them up:

(-0.4^2) + (0.2^2) + (-0.1^2) + (-0.1^2) + (0.1^2) + (0.1^2) + (0.1^2) + (-0.1^2) + (0.1^2) + (0.1^2) + (0.1^2) + (0.1^2) = 0.06

Finally, we divide the sum by the number of observations (12) and take the square root to obtain the tracking error:

Tracking Error = √(0.06 / 12) ≈ 0.0433

Therefore, the tracking error for this index fund is approximately 0.0433.

III. Tracking Difference

A. Definition and Explanation of Tracking Difference Tracking difference measures the disparity between an index fund’s total return and the total return of the benchmark index over a specific period. It quantifies the cumulative effect of the fund’s performance relative to the index’s performance. Tracking difference reflects how well the index fund replicates the index’s returns, considering factors like fund expenses, cash drag, and portfolio management decisions.

B. Importance of Tracking Difference in Assessing Index Fund Performance Tracking difference is a crucial metric as it helps investors evaluate the overall impact of the fund’s performance relative to the index. A smaller tracking difference indicates that the fund closely mirrors the index’s performance. Investors prefer index funds with lower tracking Difference, implying less deviation from the index’s returns.

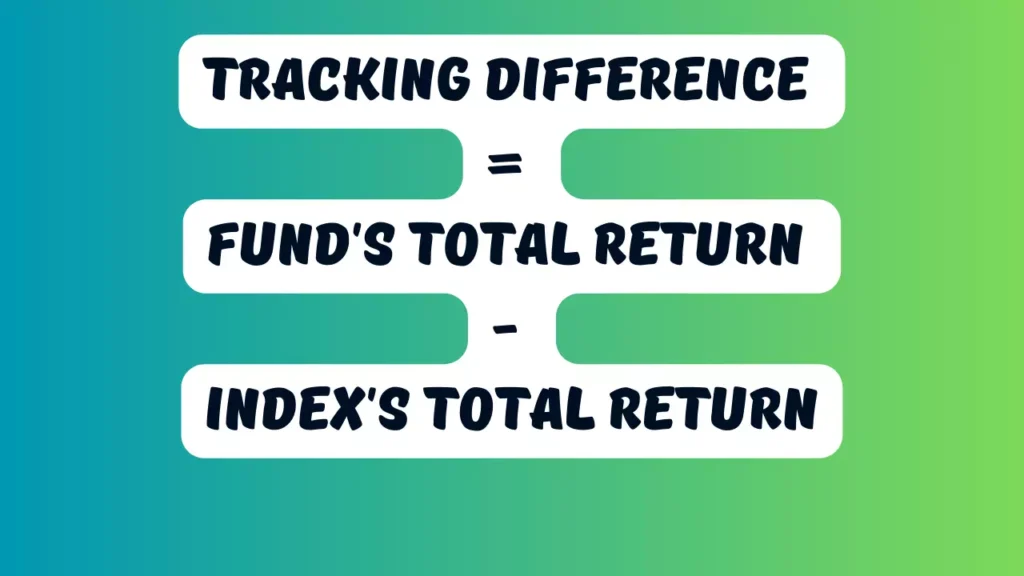

C. Formula for Tracking Difference The formula for tracking difference involves calculating the difference between the fund’s total return and the index’s total return. It can be calculated employing the following procedure:

Tracking difference = Fund’s Total Return – Index’s Total Return

Or

Tracking Difference = Fund Total Returns – Benchmark Total Returns

D. Example Illustrating Tracking Difference Calculation Let’s consider an example to illustrate the calculation of tracking difference. Suppose an index fund and its benchmark index have the following total returns over a year:

Fund’s Total Return: 8.5% Index’s Total Return: 8.8%

To calculate the tracking difference, we subtract the index’s total return from the fund’s total return:

Tracking Difference = 8.5% – 8.8% = -0.3%

Therefore, the tracking difference for this index fund is -0.3%.

IV. Comparing Tracking Error and Tracking Difference

A. Key Difference between Tracking Error and Tracking Difference Tracking error and tracking difference are distinct metrics that measure different aspects of an index fund’s performance. The key Difference between these metrics are as follows:

- Definition: Tracking error quantifies the consistency of the fund’s returns compared to the index’s returns. Tracking difference measures the disparity between the fund’s total return and the index’s total return.

- Calculation: Tracking error is calculated by determining the standard deviation of the Difference between the fund returns and the index returns, whereas tracking difference is calculated by subtracting the index’s total return from the fund’s total return.

- Focus: Tracking error primarily focuses on the volatility and consistency of the fund’s returns relative to the index, while tracking difference evaluates the overall impact of the fund’s performance compared to the index.

B. How Tracking Error and Tracking Difference Impact Investors.

Tracking error and tracking Difference have different implications for investors:

- Tracking Error: Investors generally prefer index funds with lower tracking error, as it indicates a higher level of accuracy in tracking the index’s performance. A lower tracking error suggests that the fund’s returns closely align with the index’s returns, reducing the risk of underperformance.

- Tracking Difference: Investors typically favour index funds with smaller tracking Difference, implying less deviation from the index’s returns. A smaller tracking difference indicates that the fund closely replicates the index’s performance, minimizing the impact of tracking error and potential underperformance.

C. Understanding the Relationship between Tracking Error and Tracking Difference Tracking error and tracking difference are interrelated metrics. While tracking Error measures the impulsiveness of the Difference between the fund and index returns, tracking difference captures the cumulative effect of the fund’s performance relative to the index. High tracking error can contribute to a larger tracking difference, indicating potential deviations from the index’s returns.

V. Factors Influencing Tracking Error and Tracking Difference

A. Market Conditions Market conditions, including volatility and liquidity, can impact tracking error and Difference. During high market impulsiveness, it can be challenging for index funds to accurately replicate the index’s returns, leading to increased tracking error and potentially larger tracking Difference.

B. Fund Expenses Fund expenses, such as management fees and operating costs, can impact tracking error and tracking Difference. Higher expense ratios can reduce the fund’s net returns, widening the tracking difference. Additionally, funds with higher expenses might experience difficulties replicating the index, leading to increased tracking error.

C. Rebalancing and Transaction Costs Index funds periodically rebalance their portfolios to maintain alignment with the index. Rebalancing includes buying and selling securities, which can incur transaction costs. These transaction costs can contribute to tracking Difference, especially when they are relatively high compared to the fund’s assets under management.

D. Securities Lending and Collateral Management Some index funds engage in securities lending to generate additional income. Securities lending involves loaning the fund’s holdings to other market participants in exchange for collateral. While this practice can enhance returns, it may introduce tracking Difference as the fund’s holdings may deviate from the index during the loan period.

E. Manager Skill and Fund Strategy The fund manager’s expertise and the fund’s investment strategy can influence tracking error and tracking Difference. Skilled managers with sound investment strategies aim to minimize tracking error and tracking Difference by closely aligning the fund’s holdings and actions with the index.

VI. Limitations and Considerations

A. Limitations of Tracking Error as a Measure of Performance While tracking error provides valuable insights into an index fund’s performance, it has certain limitations. Tracking error only considers the volatility of Difference between fund and index returns. It does not capture the direction or magnitude of the tracking deviations, potentially overlooking substantial underperformance or outperformance.

B. Limitations of Tracking Difference as a Measure of Performance Tracking difference, although informative, also has limitations. It solely focuses on the cumulative effect of the fund’s performance relative to the index and does not account for short-term fluctuations. A small tracking difference does not guarantee consistent tracking over extended periods.

C. Other Factors to Consider When Evaluating Index Funds While tracking Error and tracking Difference are crucial metrics, investors should consider other factors when evaluating index funds. These factors include fund size, liquidity, transparency, tax efficiency, and the fund provider’s reputation. A complete analysis of these factors provides a more holistic view of the fund’s potential performance.

VII. Conclusion

In conclusion, tracking Error and tracking Difference are essential metrics for assessing the performance of index funds. Tracking error measures the consistency of the fund’s returns compared to the index while tracking difference quantifies the disparity between the fund’s total return and the index’s total return. By understanding these metrics and their influencing factors, investors can make more informed decisions when selecting index funds for their investment portfolios.

FAQs (Frequently Asked Questions)

What is the ideal range for tracking Error in index funds?

The perfect range for tracking error depends on various factors, including the specific tracked index and investor preferences. Generally, lower tracking error are preferred, but it is essential to consider other factors and compare tracking error within the same asset class or index category for a more accurate assessment.

Can tracking Difference be negative?

Yes, tracking Difference can be negative. A negative tracking difference indicates that the fund has underperformed the index over the period. Investors should analyze the reasons behind the negative tracking difference and evaluate whether it aligns with their investment goals and expectations.

How often should investors review tracking error and tracking Difference?

Investors should periodically review tracking error and Difference to ensure the fund meets its investment objectives. Reviewing these metrics quarterly or semi-annually can provide meaningful insights into the fund’s tracking accuracy and potential deviations from the index.

Are there any index funds with zero tracking error?

Achieving a tracking error of zero is highly unlikely in practice. Various factors, including fund expenses, transaction costs, and tracking limitations, can contribute to deviations from the index’s returns. However, some index funds strive to minimize tracking error and closely follow the index as accurately as possible.

What are some strategies to minimize tracking error and tracking Difference?

Index fund managers employ several strategies to reduce tracking error and tracking Difference. These strategies include efficient portfolio management, optimized trading techniques, minimizing fund expenses, closely monitoring the index’s composition and rebalancing requirements. Engaging in securities lending and collateral management can also help mitigate tracking Difference, but it introduces its considerations and risks.

Disclaimer:

This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory. This is not an investment advisory. The blog is for information purposes only. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Past performance is not indicative of future returns. Please consider your specific investment requirements, risk tolerance, goal, time frame, risk and reward balance, and the cost associated with the investment before choosing a fund or designing a portfolio that suits your needs. The performance and returns of any investment portfolio can neither be predicted nor guaranteed.

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Do conduct your research along with registered financial advisors before making any investment decisions. Ace Equity Research and the team are not accountable for the investment views provided in the article.