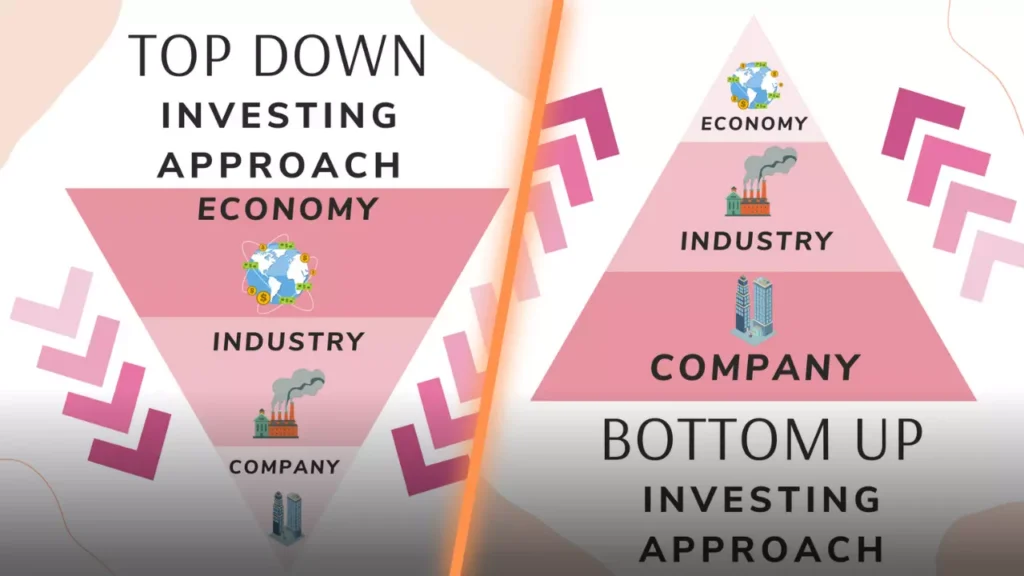

Investing in financial markets requires careful consideration and a well-defined strategy. Two popular investment approaches investors are often confused about employing are top-down vs. bottom-up investing approaches. These approaches differ in their perspectives, analysis methods, and decision-making processes. In this article, we will explore each investing approach, its benefits and drawbacks, and provide answers to frequently asked questions to help you make informed investment decisions.

Top-Down Investing: Taking a Macro Perspective

Top-down investing starts with analysing the overall macroeconomic environment and market trends. Investors using this approach examine broad economic factors, such as GDP growth, interest rates, inflation, and geopolitical events. By understanding the bigger picture, they identify sectors or industries expected to perform well under the prevailing economic conditions. Once the sectors are identified, investors select individual securities within those sectors.

Benefits of Top-Down Investing

- Holistic view: Top-down investing allows investors to consider broader market trends and economic indicators, enabling them to capture potential opportunities.

- Efficient allocation: By focusing on promising sectors, investors can allocate their resources effectively, maximising the potential for returns.

- Risk management: Diversification across sectors reduces the impact of sector-specific risks, providing a balanced portfolio.

Drawbacks of Top-Down Investing

- Lack of specificity: This approach may overlook specific company-level factors, potentially missing out on hidden gems within sectors.

- Macro factors’ influence: The performance of the chosen sectors heavily relies on the accuracy of macroeconomic predictions, which can be challenging.

Bottom-Up Investing: Focusing on Individual Securities

In contrast to top-down investing, the bottom-up approach concentrates on individual securities rather than macroeconomic factors. Investors using this approach analyse the fundamental aspects of companies, such as financial statements, management teams, competitive advantages, and growth prospects. The goal is to identify undervalued or overlooked companies with strong potential for growth. Portfolio construction is based on the attractiveness of individual securities rather than the overall market outlook.

Benefits of Bottom-Up Investing

- In-depth analysis: This approach allows investors to thoroughly examine the underlying fundamentals of companies, potentially uncovering valuable investment opportunities.

- Flexibility: Investors can adjust their portfolios based on individual company analysis without being limited by sector-specific constraints.

- Unique opportunities: By focusing on individual securities, investors can discover hidden gems that may not be apparent from a macro perspective.

Drawbacks of Bottom-Up Investing

- Market trends oversight: This approach may need to fully capture the influence of broader market trends and systemic risks.

- Lack of diversification: Concentrating on individual securities can lead to a less diversified portfolio, potentially increasing the impact of company-specific risks.

Top-Down vs. Bottom-Up Approaches Comparison

The top-down and bottom-up approaches have distinct characteristics but are not mutually exclusive. Combining these approaches can provide a more comprehensive investment strategy. Let’s explore these two approaches’ key differences and potential synergies.

- Perspective and focus: Top-down investing takes a macro view, while bottom-up investing focuses on individual securities.

- Data analysis and decision-making: Top-down investors rely on macroeconomic indicators, while bottom-up investors emphasise company-specific analysis.

- Risk management and portfolio construction: Top-down investors diversify across sectors, whereas bottom-up investors concentrate on individual securities.

By combining these approaches, investors can benefit from both the macro view and the detailed analysis. Through the top-down approach, they can identify sectors with growth potential and then select the best-performing securities within those sectors using bottom-up analysis. This integrated approach enhances decision-making, reduces risks, and improves portfolio diversification.

Integrating Top-Down Investing and Bottom-Up Strategies:

Developing a successful investment strategy requires carefully combining various approaches considering macroeconomic factors and individual company analysis. Among the popular investment methodologies are the top-down and bottom-up strategies, which, when used in tandem, can provide a more comprehensive perspective and informed decision-making.

To effectively integrate the top-down and bottom-up investment strategies, consider the following steps:

Begin with the top-down approach: Initiate the investment process by analysing the overall economic conditions and identifying sectors with favourable prospects. It provides a framework for narrowing down the universe of potential investments.

Select sectors and industries: Based on the top-down analysis, focus on sectors that offer growth potential and align with your investment goals. Identify companies within these sectors that demonstrate solid fundamentals and growth prospects.

Conduct bottom-up analysis: Perform in-depth research on individual companies within the chosen sectors. Evaluate their financial health, competitive positioning, and management quality. Seek out companies that are undervalued relative to their growth potential.

Construct a diversified portfolio: Build a well-diversified portfolio of stocks from different sectors that have passed top-down and bottom-up analyses. This approach helps mitigate risks associated with specific industries or companies.

Monitor and adapt: Regularly review your investments, keeping a close eye on changes in the macroeconomic landscape, industry dynamics, and company-specific factors. Adjust your portfolio to capitalise on emerging opportunities or mitigate potential risks.

By integrating top-down and bottom-up investment strategies, investors can benefit from a comprehensive and well-informed approach to decision-making. The top-down analysis provides a macroeconomic framework, while the bottom-up research focuses on selecting high-quality individual investments.

This blended approach allows investors to capitalise on favourable market trends while identifying companies with strong growth potential. By maintaining discipline, diversifying their portfolios, and regularly reviewing their investments, investors can increase their chances of achieving optimal results.

Conclusion

Understanding the differences between top-down and bottom-up investing strategies is crucial for making informed investment decisions. While top-down investing takes a macro perspective and focuses on sectors, bottom-up investing dives deep into individual securities. You can build a robust investment strategy by combining these approaches or selecting one that aligns with your investment goals, risk tolerance, and preferences. Conduct thorough research, diversify your portfolio, and adapt to changing market conditions for long-term investment success.

FAQs

Can I combine top-down and bottom-up strategies in my portfolio?

Absolutely! Connecting these strategies allows you to leverage the strengths of each approach. You can start with a top-down perspective to identify attractive sectors and then perform bottom-up analysis to select individual securities within those sectors.

Which approach is better for long-term investors?

Both methods can be suitable for long-term investors. Top-down investing helps identify sectors with long-term growth potential, while bottom-up investing allows for selecting individual securities with solid fundamentals. Consider your investment goals, risk tolerance, and preferences when choosing the approach that aligns with your long-term strategy.

How do top-down and bottom-up approaches differ in risk management?

Top-down investing diversifies risk by allocating across sectors, reducing the impact of sector-specific risks. Bottom-up investing focuses on individual securities, potentially increasing the exposure to company-specific risks. It’s essential to assess your risk tolerance and manage risk accordingly.

What are some successful examples of investors using top-down and bottom-up strategies?

Many successful investors combine these strategies. Warren Buffett, for instance, uses a bottom-up approach to analyse individual companies but also incorporates a top-down view by considering broader market trends and macroeconomic factors.

5. Should I focus more on macroeconomic factors or individual company analysis when making investment decisions?

It depends on your investment style and preferences. If you believe in the power of macro trends and want to capture broader market movements, focus on macroeconomic factors. If you prefer in-depth analysis and identifying undervalued companies, emphasise individual company analysis. You can also strike a balance by using a combination of both approaches.

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory. It is not an investment advisory. The blog is for information purposes only. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Past performance is not indicative of future returns. Please consider your specific investment requirements, risk tolerance, goal, time frame, risk and reward balance, and the cost associated with the investment before choosing a fund or designing a portfolio that suits your needs. The performance and returns of any investment portfolio can neither be predicted nor guaranteed.

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Do conduct your research along with financial advisors before making any investment decisions. Ace Equity Research and the team are not accountable for the investment views provided in the article.