Introduction to Asset Turnover Ratio

In financial analysis, the asset turnover ratio is a crucial metric to evaluate a company’s efficiency in utilising its assets to generate revenue.

It measures the company’s ability to create sales about its total assets.

By understanding the asset turnover ratio, investors and analysts can gain insights into a company’s operational efficiency and its effective utilisation of assets.

Calculation of Asset Turnover Ratio

The asset turnover ratio calculates a company’s net sales or revenue by its average total assets. The formula for the calculation of the asset turnover ratio is as follows:

Asset Turnover Ratio (ATR) = Net Sales / Average Total Assets

Example Calculation:

Let’s consider Company XYZ with net sales of $1,000,000 and average total assets of $500,000.

Asset Turnover Ratio = $1,000,000 / $500,000 = 2

Company XYZ generated $2 in sales for every $1 of average total assets.

Exploring Indian Stocks

To illustrate the concept of asset turnover ratio, let’s examine some real-life examples from the Indian stock market:

- Hindustan Unilever Limited (HUL) HUL, a prominent consumer goods company, boasts a high asset turnover ratio of 4.25. It indicates that for every ₹1 of HUL’s assets, it generates ₹4.25 in sales. Such a remarkable ratio showcases HUL’s efficient utilisation of its assets to drive revenue.

- Infosys Limited Infosys, a renowned technology company, exhibits an asset turnover ratio of 3.25. It means that for every ₹1 of assets held by Infosys, it generates ₹3.25 in sales. It highlights the company’s ability to optimise asset utilisation, generating substantial sales.

- Tata Consultancy Services (TCS) TCS, another notable technology company, boasts an asset turnover ratio of 3.0. It signifies that every ₹1 of assets in TCS’s possession generates ₹3.0 in sales. The ratio reflects TCS’s effective asset management strategies, enabling it to drive revenue growth.

- Reliance Industries Limited (RIL) RIL, a prominent energy and petrochemical company, exhibits an asset turnover ratio of 2.75. It suggests that for every ₹1 of assets held by RIL, it generates ₹2.75 in sales. The ratio underscores RIL’s efficiency in leveraging its assets to generate substantial sales figures.

- Maruti Suzuki India Limited (MSIL) MSIL, a leading automobile company, showcases an asset turnover ratio of 2.5. It indicates that for every ₹1 of assets MSIL possesses, it generates ₹2.5 in sales. The ratio highlights MSIL’s adeptness in capitalising on its support to drive revenue growth.

It’s important to note that asset turnover ratios can vary significantly across industries. Technology companies, for instance, often demonstrate higher asset turnover ratios than consumer goods companies due to their reliance on intellectual property rather than physical assets.

Insights from US Stocks

Expanding our analysis to the US stock market, let’s explore some examples of asset turnover ratios:

- Amazon (AMZN) AMZN boasts an asset turnover ratio of 1.16, indicating that for every $1 of assets it holds, it generates $1.16 in sales. The ratio showcases Amazon’s effective utilisation of its assets to drive revenue growth.

- Walmart (WMT) WMT exhibits an impressive asset turnover ratio of 2.30, signifying that for every $1 of its assets, it generates $2.30 in sales. It demonstrates Walmart’s adeptness in leveraging its assets to generate substantial revenue.

- Target (TGT) TGT showcases an asset turnover ratio of 2.00, suggesting that for every $1 of assets it holds, it generates $2.00 in sales. The ratio highlights Target’s effective asset management strategies and revenue generation capabilities.

- Home Depot (HD) HD boasts an asset turnover ratio of 3.00, indicating that for every $1 of assets it possesses, it generates $3.00 in sales. It highlights Home Depot’s efficiency in utilising its assets to drive significant revenue growth.

- Costco (COST) COST exhibits an asset turnover ratio of 2.60, implying that for every $1 of assets it holds, it generates $2.60 in sales. The ratio reflects Costco’s ability to efficiently utilise its assets to generate substantial revenue figures.

Just as in the Indian market, the asset turnover ratio in the US market can vary across different industries. Retailers, for example, often demonstrate higher asset turnover ratios than technology companies due to their inventory-driven operations.

Importance of Asset Turnover Ratio

The asset turnover ratio helps investors and analysts assess a company’s operational efficiency and ability to generate sales from its assets.

A higher asset turnover ratio (ATR) indicates that the company generates more revenue per support unit, which is generally positive. It shows that the company utilises its assets effectively and efficiently to generate sales.

Interpreting the Asset Turnover Ratio

When analysing the asset turnover ratio, a higher ratio is generally preferred as it signifies that the company is utilising its assets efficiently.

However, it’s important to consider industry norms and compare the ratio with peers in the same industry for a more accurate assessment. A low asset turnover ratio may indicate the underutilisation of assets or inefficiencies in the company’s operations.

Factors Affecting the Asset Turnover Ratio

Several factors can influence the asset turnover ratio of a company. These factors include the nature of the industry, the company’s business model, the quality of assets, pricing strategies, and inventory management.

Understanding these factors is crucial to effectively interpreting and comparing the asset turnover ratio.

Examples of High and Low Asset Turnover Ratios

A company with a high asset turnover ratio efficiently generates revenue from its assets. For example, a retail company that swiftly sells its inventory can achieve a high asset turnover ratio.

On the other hand, a company with a low asset turnover ratio may indicate poor sales performance or underutilisation of assets.

Comparing Asset Turnover Ratios in Different Industries

It’s essential to compare the asset turnover ratio within the same industry, as different industries have varying asset requirements and revenue generation models.

Industries with high-value assets like manufacturing or construction may naturally have lower asset turnover ratios than service-based industries.

Limitations of Asset Turnover Ratio

Let’s explore the limitations of the asset turnover ratio and discuss its implications.

Limitation 1: Variability of Asset Values

One of the limitations of the asset turnover ratio is the variability of asset values. The ratio relies on the average total assets, which fluctuate significantly over time due to various factors such as asset acquisition, depreciation, and disposal.

This variability can distort the ratio and make comparing companies with different asset structures or those operating in other industries difficult.

Limitation 2: Industry Differences

Different industries have varying asset turnover ratio benchmarks due to their unique characteristics and business models. Comparing the asset turnover ratio of companies across sectors may not provide meaningful insights.

For example, a capital-intensive industry like manufacturing may have a lower asset turnover ratio than a service-based industry, where assets are less significant. Therefore, industry context is crucial when interpreting the ratio.

Limitation 3: Ignoring Profit Margins

The asset turnover ratio focuses solely on revenue generation and asset utilisation without considering profit margins. It does not provide insights into a company’s profitability.

A high asset turnover ratio may indicate operational efficiency, but it may only be financially healthy if the company has high-profit margins. Analysing the asset turnover ratio and profit margins is essential to assess a company’s financial performance comprehensively.

Limitation 4: Inadequate Consideration of Seasonality

The asset turnover ratio calculates average total assets, which may not account for seasonality in sales or production. Some industries experience significant fluctuations in sales volume during certain periods of the year.

These seasonal variations may influence a company’s asset turnover ratio, leading to a distorted picture of its overall performance. Analysing the ratio over multiple periods or considering industry-specific seasonality is necessary for accurate interpretation.

Limitation 5: Ignores Non-operating Assets and Liabilities

The asset turnover ratio focuses on the operational aspect of a company’s assets and does not consider non-operating assets or liabilities. Non-operating assets, such as investments or idle properties, are not directly related to generating sales and may not be reflected in the ratio.

Similarly, non-operating liabilities, such as long-term debt, may not be considered. Ignoring these factors can limit the ratio’s effectiveness in assessing a company’s financial health.

Limitation 6: Lack of Context and Comparative Analysis

When analysed in isolation, the asset turnover ratio provides insights into a company’s efficiency but lacks context.

A single value of the ratio only provides little information if compared to historical data, industry benchmarks, or competitors’ ratios. Comparative analysis is crucial to understand whether a company’s asset turnover ratio is favourable.

Limitation 7: Manipulation and Financial Shenanigans

As with any financial metric, the asset turnover ratio is susceptible to manipulation and financial shenanigans. Companies may employ various tactics to artificially inflate sales figures or manipulate asset values to improve the ratio.

These practices can deceive investors and paint a misleading picture of a company’s financial performance. Investors should remain vigilant and conduct thorough due diligence to detect potential manipulation.

While the asset turnover ratio is a valuable tool for assessing operational efficiency, it has limitations that must be considered.

Variability of asset values, industry differences, ignoring profit margins, inadequate consideration of seasonality, ignoring non-operating assets and liabilities, lack of context, and susceptibility to manipulation are some of the limitations associated with the asset turnover ratio.

By understanding these limitations and conducting a comprehensive analysis, investors and analysts can better understand a company’s financial performance.

Financial Shenanigans Associated with Asset Turnover Ratio

A higher asset turnover ratio generally signifies better operational efficiency and effective asset utilisation.

Let’s explore various financial shenanigans associated with the asset turnover ratio and highlights the red flags to watch for.

Manipulating Sales Figures

One common financial shenanigan associated with the asset turnover ratio is the manipulation of sales figures. Companies may artificially use aggressive sales recognition practices to inflate their revenue numbers.

They may recognise sales prematurely, record fictitious sales, or use channel stuffing to boost their reported sales figures. By artificially inflating sales, companies can increase their asset turnover ratio, creating a misleading perception of operational efficiency.

Inflating Asset Values

Another financial shenanigan linked to the asset turnover ratio is the inflation of asset values. Companies may overstate the value of their assets on the balance sheet through various means, such as overvaluing inventory, capitalising expenses that should be treated as operating expenses, or inflating the value of fixed assets.

By boosting asset values, companies can artificially increase the denominator of the asset turnover ratio, leading to a higher ratio and potentially misleading investors.

Excessive Use of Leverage

Excessive leverage is another way companies can manipulate the asset turnover ratio. By taking on excessive debt or using off-balance-sheet financing, companies can artificially inflate their total assets without a corresponding increase in sales.

This manipulation increases the denominator of the asset turnover ratio, resulting in a higher ratio. However, it does not necessarily reflect improved operational efficiency or increased sales generation.

Hiding Liabilities

Companies may engage in financial shenanigans by hiding liabilities, which can impact the accuracy of the asset turnover ratio.

By failing to disclose or understate their liabilities, companies create an inflated picture of their asset base, artificially inflating the asset turnover ratio.

This manipulation can mislead investors into believing that the company is more efficient in generating sales from its assets than it is.

Misclassification of Expenses

Misclassifying expenses is another technique used to manipulate the asset turnover ratio. By misclassifying certain operating expenses as capital expenditures, companies can artificially increase the value of their assets and, consequently, the asset turnover ratio.

This misrepresentation can lead to a distorted perception of operational efficiency and asset utilisation.

Red Flags to Watch For

To protect against financial shenanigans associated with the asset turnover ratio, investors should be vigilant for the following red flags:

- Unexplained or inconsistent changes in the asset turnover ratio over time.

- Discrepancies between reported sales figures and industry benchmarks.

- Significant differences between the asset turnover ratio and other financial performance metrics.

- Unusual patterns or trends in revenue recognition or expense classification.

- Lack of transparency in financial reporting or consistency in disclosures.

Consequences of Financial Shenanigans

Engaging in financial shenanigans can have severe consequences for companies and their stakeholders. If discovered, these deceptive practices can result in legal and regulatory penalties, damage to the company’s reputation, loss of investor trust, and even bankruptcy.

Additionally, investors who rely on manipulated financial statements may suffer financial losses when the company’s true financial position is revealed.

How to Protect Against Financial Shenanigans

To protect against financial shenanigans associated with the asset turnover ratio, investors can take the following steps:

- Conduct thorough due diligence and analysis of a company’s financial statements.

- Compare the asset turnover ratio with industry benchmarks and peers.

- Look for consistency and reasonableness in reported financial figures.

- Scrutinise revenue recognition practices and expense classifications.

- Seek independent third-party audits and reviews of financial statements.

The asset turnover ratio is valuable for assessing a company’s operational efficiency. However, knowing the potential financial shenanigans associated with this ratio is essential.

Companies may employ tactics to deceive investors by manipulating sales figures, inflating asset values, excessive leverage, hiding liabilities, and misclassifying expenses.

By understanding these shenanigans and being vigilant for red flags, investors can make more informed decisions and protect themselves against fraudulent practices.

Combination of Ratios for Effective Analysis

Various ratios can be used alongside the asset turnover ratio better to understand a company’s financial performance and operational efficiency.

1. Profitability Ratios

Profitability ratios help assess a company’s ability to profit from its operations. Investors and analysts can evaluate how efficiently a company utilises its assets to generate profits by analysing profitability ratios alongside the asset turnover ratio. Key profitability ratios include:

- Gross Profit Margin: This ratio measures the percentage of revenue/income after deducting the cost of goods sold. A high gross profit margin indicates efficient cost control and pricing strategies.

- Net Profit Margin: The net profit margin represents the percentage of revenue that remains as net profit after deducting all expenses, including taxes and interest. A higher net profit margin reflects better overall profitability.

By comparing profitability ratios with the asset turnover ratio, investors can assess whether a company’s operational efficiency translates into strong profitability.

2. Liquidity Ratios

Liquidity ratios help gauge a company’s ability to meet short-term obligations and manage its cash flow effectively.

While the asset turnover ratio focuses on asset utilisation, liquidity ratios provide insights into a company’s financial health. Relevant liquidity ratios to consider alongside the asset turnover ratio include the following:

- Current Ratio: The current ratio compares a company’s assets to its current liabilities. A ratio above 1 indicates that a company has sufficient short-term investments to cover its obligations.

- Quick Ratio: The quick ratio (QR), or the acid-test ratio, measures a company’s ability to meet short-term obligations without relying on inventory. It excludes inventory from current assets since it may not be readily convertible to cash.

Analysing liquidity ratios with the asset turnover ratio helps determine whether a company can efficiently convert its assets into cash to meet its obligations.

3. Debt Ratios

Debt ratios provide insights into a company’s capital structure and financial leverage. They indicate the proportion of debt in a company’s assets and equity.

Investors can assess a company’s risk profile and financial stability by considering debt ratios alongside the asset turnover ratio. Key debt ratios to examine include:

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its equity. A higher ratio suggests higher financial leverage and increased risk.

- Interest Coverage Ratio: The interest coverage ratio measures a company’s capability to meet its interest payments. It compares earnings before interest and taxes (EBIT) to interest expenses.

Evaluating debt ratios alongside the asset turnover ratio helps determine the effect of debt on a company’s operational efficiency and financial performance.

4. Return on Investment (ROI) Ratios

Return on investment ratios measures the profitability of investments made by a company.

Investors can evaluate the effectiveness of a company’s asset utilisation in generating returns by considering ROI ratios alongside the asset turnover ratio. Key ROI ratios to analyse include:

- Return on Assets (ROA): ROA measures the profitability of a company’s assets by comparing net income to average total assets. A higher ROA indicates more efficient asset utilisation.

- Return on Equity (ROE): ROE measures the return earned on shareholders’ equity. It reflects how effectively a company generates profits from the shareholders’ investment.

By examining ROI ratios alongside the asset turnover ratio, investors can gain insights into a company’s ability to generate returns from its assets and equity.

While the asset turnover ratio is a valuable metric to assess a company’s operational efficiency, considering other ratios in combination provides a more comprehensive understanding of its financial performance.

Investors and analysts can gain deeper insights into a company’s financial health, operational efficiency, and overall performance by analysing profitability, liquidity, debt, and ROI ratios alongside the asset turnover ratio.

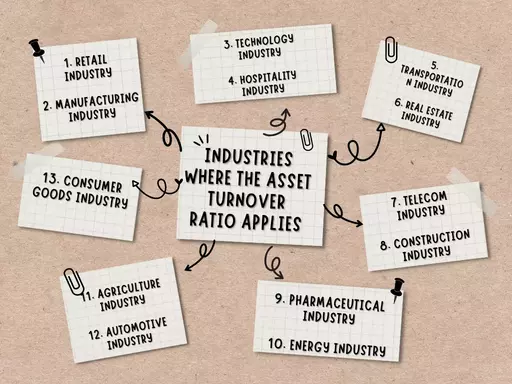

Industries where it Applies

Now, let’s explore the industries where the asset turnover ratio holds particular significance.

1. Retail Industry

The retail industry is one of the primary sectors where the asset turnover ratio applies. Retail companies, including supermarkets, department stores, and e-commerce platforms, rely heavily on managing inventory and utilising their physical assets effectively.

By optimising the use of their assets, such as store spaces, warehouses, and distribution centres, retail companies aim to generate higher sales and improve profitability.

2. Manufacturing Industry

The manufacturing industry involves the production of finished goods on a large scale. Manufacturing companies typically invest significantly in machinery, equipment, and production facilities.

The asset turnover ratio plays a crucial role in assessing the efficiency of these companies in utilising their assets to drive sales and maintain profitability.

3. Technology Industry

The technology industry, including software development, hardware manufacturing, and IT services, often has a different asset structure than traditional industries.

Technology companies rely more on intellectual property, research and development, and intangible assets than physical ones.

However, the asset turnover ratio remains relevant as it assesses the efficiency of utilising assets to generate sales and revenue.

4. Hospitality Industry

The hospitality industry, encompassing hotels, resorts, restaurants, and travel services, also benefit from assessing the asset turnover ratio. In this industry, assets such as properties, facilities, and equipment contribute significantly to revenue generation.

Optimising the utilisation of these assets allows hospitality businesses to enhance their operational efficiency and deliver better customer experiences.

5. Transportation Industry

The transportation industry, including airlines, shipping companies, logistics providers, and railways, relies heavily on its assets, such as fleets, infrastructure, and transportation equipment.

The asset turnover ratio plays a crucial role in assessing the efficiency of these assets in generating revenue through the movement of goods and passengers.

6. Real Estate Industry

The real estate industry involves developing, selling, and managing properties. Real estate companies utilise their assets, including land, buildings, and rental properties, to generate income through sales or rental activities.

By assessing the asset turnover ratio, investors and analysts can evaluate the effectiveness of utilising these assets to generate revenue and assess the profitability of real estate businesses.

(Note: While real estate companies may possess substantial assets, including properties and land, the asset turnover ratio may not accurately reflect their financial performance or operational efficiency.)

7. Telecom Industry

Telecommunication companies, including mobile network operators and internet service providers, heavily rely on their infrastructure assets to provide communication services.

These assets include network equipment, towers, cables, and data centres.

The asset turnover ratio helps evaluate how efficiently telecom companies utilise their assets to generate revenue and sustain their operations in a highly competitive industry.

8. Construction Industry

The construction industry involves the development of infrastructure, residential and commercial buildings.

Construction companies heavily rely on their assets, such as heavy machinery, equipment, and construction materials, to carry out projects.

Assessing the asset turnover ratio helps evaluate the efficiency of utilising these assets to generate revenue and maintain profitability in a project-based business model.

9. Pharmaceutical Industry

Pharmaceutical companies invest significantly in research and development, production facilities, and intellectual property rights.

The asset turnover ratio allows investors and analysts to assess the effectiveness of utilising these assets to generate sales and evaluate the operational efficiency of pharmaceutical companies.

10. Energy Industry

The energy industry encompasses companies producing, distributing, and selling various energy sources, including oil, gas, renewable energy, and utilities.

These companies invest substantially in energy exploration, production facilities, and infrastructure. Evaluating the asset turnover ratio helps assess the efficiency of utilising these assets to generate revenue and measure energy companies’ financial performance.

11. Agriculture Industry

The agriculture industry involves cultivating, harvesting, and processing crops and livestock. Agricultural companies rely on their assets, such as farmland, machinery, and livestock, to generate revenue through agricultural activities.

By analysing the asset turnover ratio, investors and analysts can evaluate the efficiency of utilising these assets to drive sales and profitability.

12. Automotive Industry

The automotive industry comprises companies designing, manufacturing, and selling automobiles and related products.

Automotive companies heavily invest in production facilities, research and development, and brand development.

Assessing the asset turnover ratio allows for evaluating how effectively these assets contribute to revenue generation and the operational efficiency of automotive companies.

13. Consumer Goods Industry

The consumer goods industry includes companies that produce and distribute goods intended for individual consumption.

These companies often invest in production facilities, inventory management, and distribution networks.

By examining the asset turnover ratio, investors and analysts can assess the efficiency of utilising these assets to drive sales and evaluate the financial performance of consumer goods companies.

The asset turnover ratio is a vital financial metric applicable across various industries. It helps investors and analysts evaluate how efficiently companies utilise their assets to generate revenue and measure operational efficiency.

By understanding the industries where the asset turnover ratio holds particular significance, stakeholders can gain valuable insights into evaluating the financial performance of companies within these sectors.

Industries where it Does Not Apply

Let’s explore some industries and sectors where the asset turnover ratio may be irrelevant.

1. Service Industry

The service industry encompasses various sectors, including healthcare, consulting, hospitality, and information technology.

These industries primarily rely on human capital, expertise, and intangible assets rather than tangible assets.

As a result, the asset turnover ratio may need to reflect their operational efficiency or revenue generation capabilities accurately. For instance, a consulting firm’s success lies in the quality of its advisory services rather than utilising physical assets.

2. Intellectual Property-Driven Industries

Industries driven by intellectual property, such as software development, entertainment, and pharmaceuticals, often face unique challenges when assessing financial performance using traditional metrics like the asset turnover ratio.

These industries heavily invest in research and development, patents, copyrights, and licenses, contributing significantly to revenue generation.

Consequently, the asset turnover ratio may need to capture these intangible assets’ value and impact adequately.

3. Financial Institutions

Financial institutions, including banks, insurance companies, and investment firms, have distinct business models that differ from other industries.

Their primary source of revenue stems from interest income, premiums, fees, and commissions rather than the physical utilisation of assets.

While they possess substantial assets, such as cash, securities, and loans, their operations and profitability rely more on financial transactions and services.

Hence, the asset turnover ratio may need to provide meaningful insights into their performance.

4. Non-Profit Organisations

Non-profit organisations, such as charities, foundations, and educational institutions, operate with different objectives than for-profit businesses.

Their focus is primarily on fulfilling their mission rather than generating profits or optimising asset utilisation.

These organisations rely on donations, grants, and public funding to support their activities and initiatives.

As a result, the asset turnover ratio may need to be more suitable for evaluating their financial performance or effectiveness in achieving their objectives.

5. Government Entities

Government entities, including municipal governments, federal agencies, and public institutions, have unique financial structures and objectives.

Their revenue sources predominantly come from taxes, grants, and public funds, rather than sales or asset turnover.

Evaluating their financial performance requires specialised metrics and indicators that align with their objectives, such as budgetary efficiency and service delivery effectiveness.

How to Improve Asset Turnover Ratio

Explore strategies and best practices to improve the asset turnover ratio and enhance business profitability.

1. Streamline Inventory Management

Effective inventory management is vital in improving the asset turnover ratio, especially for manufacturing, retail, or distribution businesses.

Companies can minimise carrying costs and enhance asset turnover by optimising inventory levels, reducing excess stock, and implementing just-in-time inventory practices.

Regularly monitoring and analysing inventory turnover ratios can help identify slow-moving items, allowing businesses to take proactive measures to clear obsolete stock and streamline inventory.

2. Enhance Production Efficiency

Improving production efficiency can significantly impact the asset turnover ratio for manufacturing companies.

Businesses can maximise their asset utilisation by adopting lean manufacturing principles, optimising production processes, and reducing waste.

Implementing automation, improving workflow design, and reducing setup times, can help increase production output and enhance the turnover of assets.

3. Optimise Accounts Receivable Management

Timely collection of accounts receivable is essential for improving the asset turnover ratio, particularly for businesses that offer credit terms to customers. Implementing effective credit policies, conducting credit checks, and monitoring customer payment behaviour can help reduce the average collection period.

Offering early payment incentives or stricter credit terms for slow-paying customers can accelerate cash flow, reduce outstanding receivables, and improve the asset turnover ratio.

4. Efficient Asset Utilisation

To improve the Asset Turnover Ratio, companies must ensure the efficient utilisation of their assets. Regular maintenance and upkeep of machinery and equipment can prevent downtime and enhance operational efficiency.

Companies should also evaluate their asset base and consider divesting underperforming or obsolete assets that are not contributing to revenue generation.

Businesses can optimise asset utilisation and improve turnover by focusing on high-performing assets and disposing of unproductive ones.

5. Increase Sales and Marketing Efforts

Generating higher sales is a direct way to improve the asset turnover ratio. Effective sales and marketing strategies can help businesses reach a wider customer base, increase market share, and boost revenue.

By identifying target markets, understanding customer needs, and developing compelling value propositions, businesses can drive sales growth and improve the utilisation of their assets.

6. Enhance Supply Chain Management

Efficient supply chain management is crucial for procurement, production, and distribution businesses.

Companies can reduce costs and improve asset turnover by establishing strong relationships with suppliers, negotiating favourable terms, and optimising logistics and transportation.

Streamlining the supply chain and reducing lead times can help businesses respond quickly to customer demands, reduce inventory levels, and enhance overall efficiency.

Conclusion

The asset turnover ratio is a valuable metric allowing investors and analysts to assess a company’s operational efficiency and ability to generate sales from its assets.

By considering industry norms, analysing other financial ratios, and understanding the limitations of the ratio, stakeholders can make informed decisions about the company’s financial health and prospects.

FAQs (Frequently Asked Questions)

1. What is a good asset turnover ratio?

A good asset turnover ratio varies by industry. Generally, a higher ratio is preferred, indicating efficient asset utilisation. However, comparing the ratio within the same sector is essential for a more accurate assessment.

2. How can a company increase its asset turnover ratio?

Companies can increase their asset turnover ratio by optimising asset utilisation, streamlining operations, improving sales and marketing efforts, and focusing on product or service quality.

3. What does a low asset turnover ratio indicate?

A low asset turnover ratio may show the underutilisation of assets or inefficiencies in the company’s operations. Identifying the underlying causes and taking appropriate measures to improve the ratio is important.

4. Can the asset turnover ratio be negative?

The asset turnover ratio cannot be negative as it measures positive values and the relationship between sales and assets.

5. Is the asset turnover ratio the same as the inventory turnover ratio?

No, the asset turnover ratio and the inventory turnover ratio are different. The asset turnover ratio considers all assets, while the inventory turnover ratio specifically focuses on the efficiency of inventory utilisation.

6. Is a high asset turnover ratio always favourable?

A high asset turnover ratio generally indicates efficient asset utilisation. However, it is crucial to consider other factors, such as profit margins, industry norms, and business models, to accurately assess a company’s financial performance.

7. Are there industries where the asset turnover ratio is less relevant?

While the asset turnover ratio applies to various sectors, its significance may vary depending on the industry’s operational dynamics and asset structures. Industries heavily reliant on intellectual property or service-based models may have different evaluation metrics.

8. How can a company improve its asset turnover ratio?

Companies can enhance their asset turnover ratio by optimising inventory management, streamlining operational processes, improving sales and marketing strategies, and effectively using their assets.

9. Can the asset turnover ratio capture the value of intellectual property in certain industries

Intellectual property-driven industries, such as software development and entertainment, require metrics beyond the asset turnover ratio to assess the value of their intangible assets.

10. Can the asset turnover ratio be compared across different industries?

Comparing the asset turnover ratio across industries may be meaningless due to industry differences. It is best to compare ratios within the same drive to gain meaningful insights.

11. Is a high asset turnover ratio always favourable?

A high asset turnover ratio indicates operational efficiency, but it should be considered with other financial metrics and industry benchmarks to assess a company’s overall financial health.

12. What other ratios can complement the asset turnover ratio formula?

Some ratios that can complement the asset turnover ratio include return on assets (ROA), return on equity (ROE), gross profit margin, and net profit margin.

13. How can investors overcome the limitations of the asset turnover ratio?

Investors can overcome the limitations by considering other financial ratios, conducting a comparative analysis, analysing profit margins, and assessing industry-specific factors.

14. How can investors detect potential manipulation of the asset turnover ratio?

Investors can detect potential manipulation by conducting thorough due diligence, analysing financial statements, comparing ratios with industry benchmarks, and seeking independent audits and reviews of the company’s financials.

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory. This is not an investment advisory. The blog is for information purposes only. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Past performance is not indicative of future returns. Please consider your specific investment requirements, risk tolerance, goal, time frame, risk and reward balance, and the cost associated with the investment before choosing a fund or designing a portfolio that suits your needs. The performance and returns of any investment portfolio can neither be predicted nor guaranteed.

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Do conduct your research along with registered financial advisors before making any investment decisions. Ace Equity Research and the team are not accountable for the investment views provided in the article.