Investing is like navigating uncharted waters; choosing the right mutual fund can make all the difference. In this article, we’ll dive into the depths of two prominent funds – SBI Contra Fund and Parag Parikh Flexi Cap Fund. Buckle up as we explore their returns, investment values, and overall performance in a comparative analysis.

Return Analysis

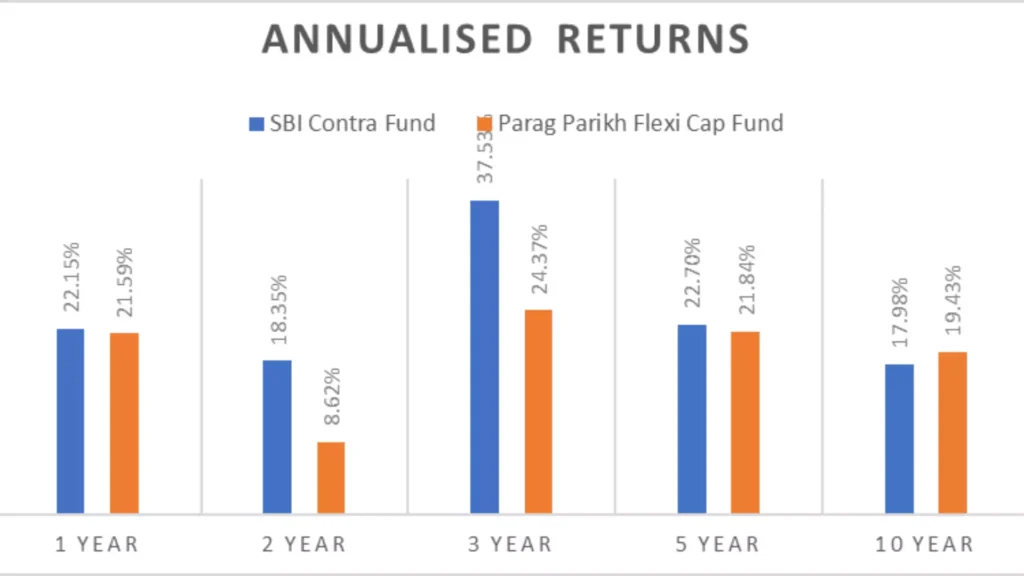

Annualized returns provide a snapshot of a fund’s performance over different periods. Let’s dissect the numbers:

1. One Year Returns

| Period Invested for | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Category Avg |

| 1 Year | 22.15% | 21.59% | 16.56% |

Both funds showcase robust performance, with SBI Contra Fund slightly edging ahead in the one-year category.

2. Two Year Returns

| Period Invested for | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Category Avg |

| 2 Year | 18.35% | 8.62% | 12.44% |

SBI Contra Fund maintains its lead, demonstrating consistency in performance over two years.

3. Three Year Returns

| Period Invested for | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Category Avg |

| 3 Year | 37.53% | 24.37% | 28.48% |

SBI Contra Fund leads in the three-year category, outperforming its counterpart and the category average.

4. Five Year Returns

| Period Invested for | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Category Avg |

| 5 Year | 22.70% | 21.84% | 18.70% |

SBI Contra Fund and Parag Parikh Flexi Cap Fund exhibit comparable returns over the five years.

5. Ten Year Returns

| Period Invested for | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Category Avg |

| 10 Year | 17.98% | 19.43% | 18.17% |

Over the decade, both funds have performed well, with the Parag Parikh Flexi Cap Fund showing a slight edge.

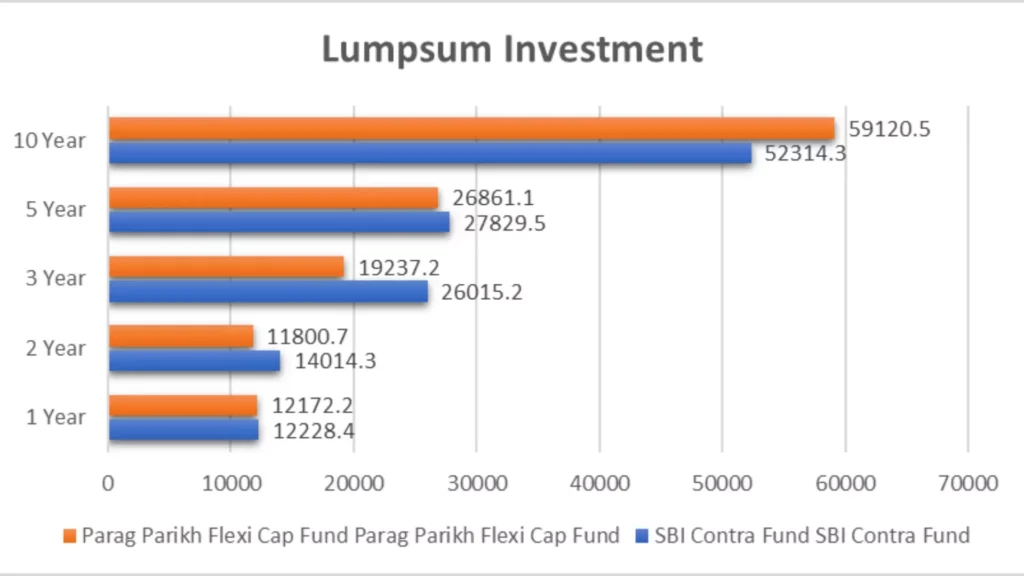

Lumpsum Investment Value (NAV as of October 30, 2023)

Lumpsum investments reflect the actual value of investments made over different periods:

| Period Invested for | SBI Contra Fund | Parag Parikh Flexi Cap Fund |

| 1 Year | ₹12,228.4 | ₹12,172.2 |

| 2 Year | ₹14,014.3 | ₹11,800.7 |

| 3 Year | ₹26,015.2 | ₹19,237.2 |

| 5 Year | ₹27,829.5 | ₹26,861.1 |

| 10 Year | ₹52,314.3 | ₹59,120.5 |

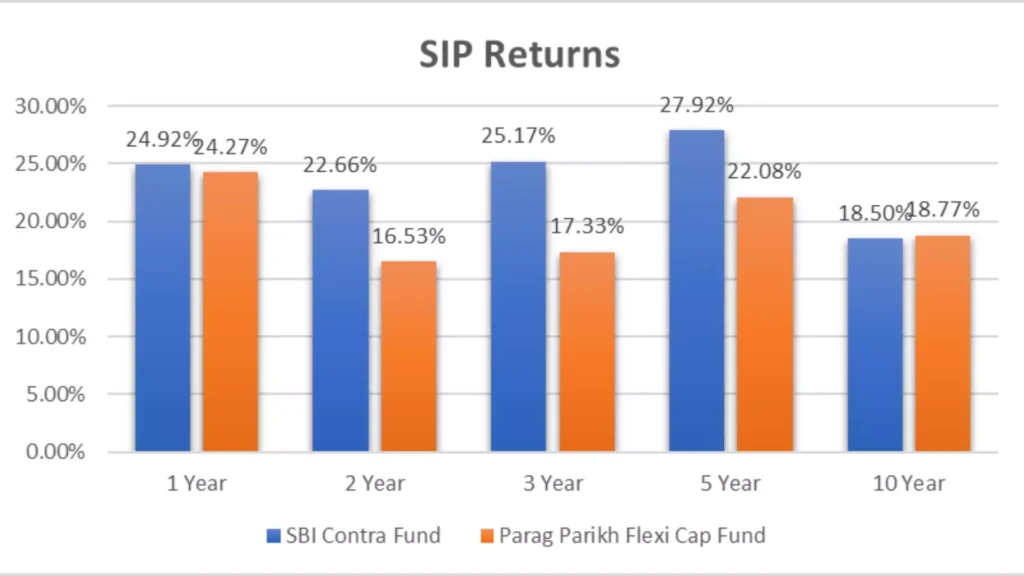

SIP Returns (NAV as of October 30, 2023)

Systematic Investment Plans (SIPs) introduce a burstiness element into the investment journey. Let’s explore the returns:

| Period Invested for | SBI Contra Fund | Parag Parikh Flexi Cap Fund |

| 1 Year | 24.92% | 24.27% |

| 2 Year | 22.66% | 16.53% |

| 3 Year | 25.17% | 17.33% |

| 5 Year | 27.92% | 22.08% |

| 10 Year | 18.50% | 18.77% |

SIP Investment Value (NAV as of October 30, 2023)

Calculating SIP values at different intervals provides a tangible perspective on investment growth:

| Period Invested for | Investments | SBI Contra Fund | Parag Parikh Flexi Cap Fund | ₹1000 SIP Started on |

| 1 Year | ₹12,000 | ₹13,563.12 | ₹13,523.94 | 28-Oct-22 |

| 2 Year | ₹24,000 | ₹29,891.11 | ₹28,253.72 | 29-Oct-21 |

| 3 Year | ₹36,000 | ₹51,844.11 | ₹46,493.5 | 30-Oct-20 |

| 5 Year | ₹60,000 | ₹119,417.77 | ₹103,805.67 | 30-Oct-18 |

| 10 Year | ₹120,000 | ₹317,585.22 | ₹322,352.53 | 30-Oct-13 |

Compare Performance

Comparing performance against benchmarks provides a holistic view:

| Category | 1 Year | 2 Year | 3 Year | 5 Year |

| SBI Contra Fund | 21.20% | 18.29% | 37.47% | 22.32% |

| Parag Parikh Flexi Cap Fund | 20.91% | 8.69% | 24.41% | 21.58% |

| Nifty 50 | 5.93% | 3.90% | 17.88% | 12.93% |

In this comparison, SBI Contra Fund and Parag Parikh Flexi Cap Fund showcase impressive returns, outpacing the Nifty 50 across all categories.

Now, we’ll dive into a detailed analysis of the BEST QUARTERS and WORST QUARTERS for two prominent funds – SBI Contra Fund and Parag Parikh Flexi Cap Fund, along with a glance at the Nifty 50. We’ll also explore the Maximum Drawdown, a key metric in understanding potential risks and losses.

BEST QUARTERS

Let’s start on a positive note by exploring the best quarters that saw these funds riding high:

Q4 – 2020

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q4 – 2020 | 28.29% | – | 22.46% |

In the last quarter of 2020, SBI Contra Fund outshone Parag Parikh Flexi Cap Fund and the Nifty 50, demonstrating an impressive return of 28.29%.

Q2 – 2020

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q2 – 2020 | 24.40% | 29.08% | 24.82% |

The second quarter of 2020 was a period of exceptional growth, with both funds showcasing remarkable returns. Parag Parikh Flexi Cap Fund slightly edged ahead, but SBI Contra Fund wasn’t far behind.

Q1 – 2017

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q1 – 2017 | 14.77% | – | 12.16% |

In the first quarter of 2017, SBI Contra Fund demonstrated solid performance, outpacing the Nifty 50.

Q3 – 2020

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q3 – 2020 | – | 16.88% | 7.84% |

In the third quarter of 2020, we witnessed the Parag Parikh Flexi Cap Fund leading the way, surpassing both the SBI Contra Fund and the Nifty 50.

Q3 – 2021

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q3 – 2021 | – | 15.31% | 12.36% |

Parag Parikh Flexi Cap Fund continued its positive streak in the third quarter of 2021, showcasing consistent performance.

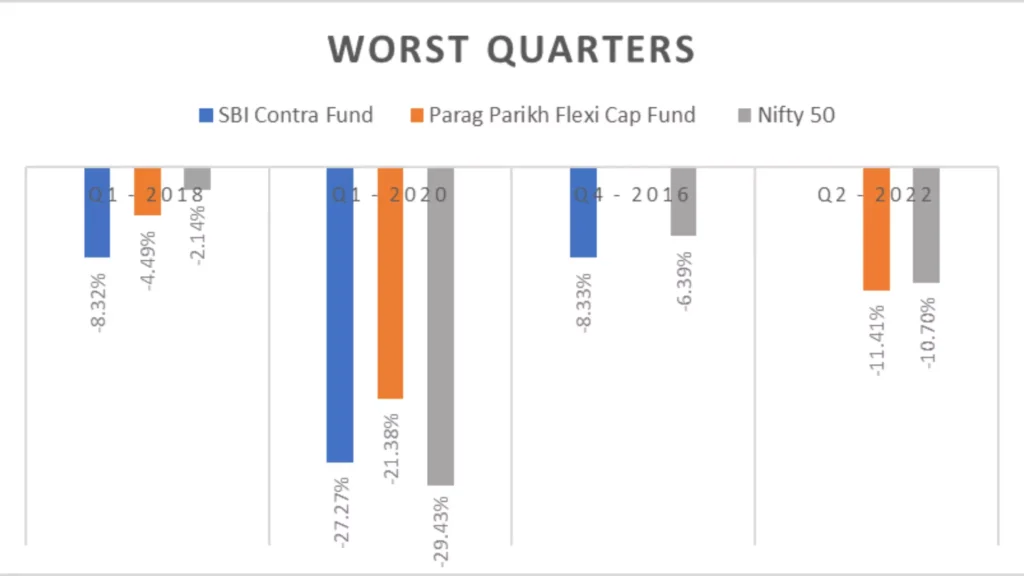

WORST QUARTERS

Now, let’s explore the challenging times, the worst quarters that tested the resilience of these funds:

Q1 – 2018

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q1 – 2018 | -8.32% | -4.49% | -2.14% |

The first quarter of 2018 presented challenges, with both funds facing negative returns, albeit SBI Contra Fund experiencing a slightly steeper decline.

Q1 – 2020

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q1 – 2020 | -27.27% | -21.38% | -29.43% |

The first quarter of 2020, marked by the onset of the global pandemic, was tumultuous for all entities, including SBI Contra Fund, Parag Parikh Flexi Cap Fund, and the Nifty 50.

Q4 – 2016

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q4 – 2016 | -8.33% | – | -6.39% |

The fourth quarter of 2016 saw a dip in returns for both funds, with SBI Contra Fund experiencing a slightly higher downturn.

Q2 – 2022

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q2 – 2022 | – | -11.41% | -10.70% |

Both funds faced challenges in the second quarter of 2022, reflecting the market’s volatility.

Maximum Drawdown

Now, let’s delve into the Maximum Drawdown, a crucial metric indicating the potential risk and loss magnitude:

3-Year Analysis

| Metric | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Category |

| 3-Year | -5.98 | -14.01 | -13.07 |

The 3-year Maximum Drawdown numbers reveal the extent of potential losses during this period. While both funds faced downturns, Parag Parikh Flexi Cap Fund experienced a deeper drawdown.

5-Year Analysis

| Metric | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Category |

| 5-Year | -31.9 | -23.13 | -36.21 |

In the 5-year category, both funds navigated downturns reasonably well, with SBI Contra Fund showing resilience with a slightly lower drawdown.

10-Year Analysis

| Metric | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Category |

| 10-Year | -38.04 | -23.13 | -41.53 |

Over the ten years, both funds demonstrated resilience, but the SBI Contra Fund showcased a lower drawdown than the Parag Parikh Flexi Cap Fund.

Understanding the nuances of mutual funds is like deciphering a complex code. In this journey, risk analysis plays a pivotal role. Analyzing the best and worst quarters and the Maximum Drawdown provides investors valuable insights to make informed decisions.

For investors, understanding mutual funds’ annualized and quarterly results is akin to reading the weather forecast before setting sail. Over the years, we’ll delve into the performance of two notable funds – SBI Contra Fund and Parag Parikh Flexi Cap Fund – to provide insights that could guide investors in making informed decisions.

Annualized Results (NAV as of October 30, 2023)

Annualized returns are a barometer of a fund’s performance over various periods. Let’s take a closer look at the returns of the SBI Contra Fund, Parag Parikh Flexi Cap Fund, and the Nifty 50 from 2016 to 2023:

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| 2023 | 19.70% | 22.89% | 4.85% |

| 2022 | 13.63% | -6.29% | 3.24% |

| 2021 | 49.11% | 45.52% | 23.79% |

| 2020 | 30.61% | 33.99% | 14.77% |

| 2019 | -0.34% | 15.48% | 11.53% |

| 2018 | -13.55% | 0.22% | 4.09% |

| 2017 | 41.06% | 30.10% | 27.58% |

| 2016 | 2.40% | 4.11% | 2.72% |

Outperformance Analysis

Understanding how often a fund outperforms its benchmark or peers is crucial. Here’s a comparative analysis of the SBI Contra Fund and Parag Parikh Flexi Cap Fund:

| Outperformance | SBI Contra Fund | Parag Parikh Flexi Cap Fund |

| No. Of Times | 3 | 5 |

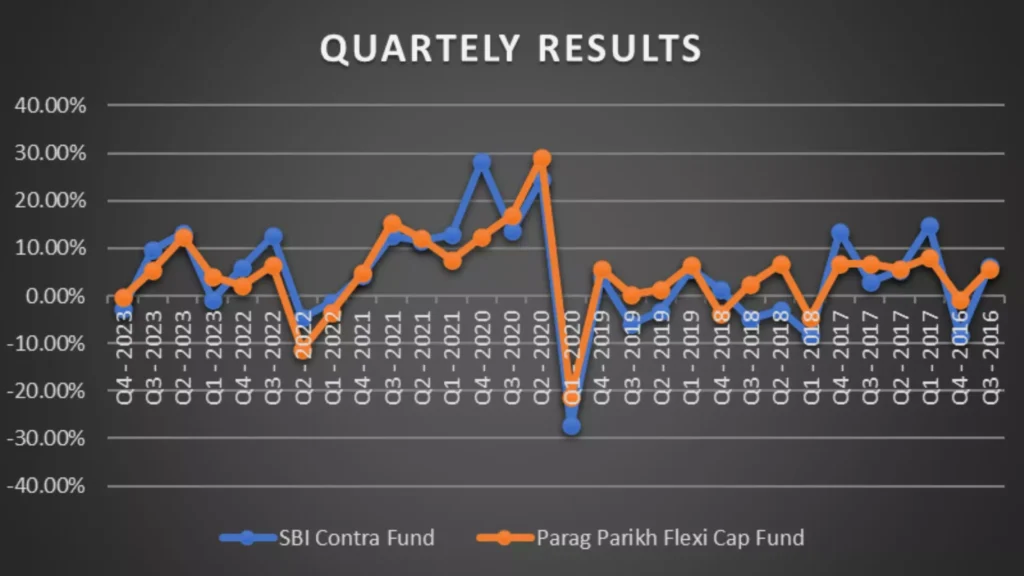

Quarterly Results (NAV as of October 30, 2023)

Quarterly results offer a more granular view, helping investors adapt to the ever-changing market conditions. Let’s explore the quarterly performance of both funds and the Nifty 50:

| Period | SBI Contra Fund | Parag Parikh Flexi Cap Fund | Nifty 50 |

| Q4 – 2023 | -2.71% | -0.20% | -2.30% |

| Q3 – 2023 | 9.62% | 5.38% | 1.07% |

| Q2 – 2023 | 13.20% | 12.41% | 10.29% |

| Q1 – 2023 | -0.85% | 3.95% | -4.60% |

| Q4 – 2022 | 5.81% | 2.29% | 7.76% |

| Q3 – 2022 | 12.55% | 6.59% | 8.52% |

| Q2 – 2022 | -4.56% | -11.41% | -10.70% |

| Q1 – 2022 | -1.33% | -3.57% | -0.91% |

| Q4 – 2021 | 4.34% | 4.75% | -1.02% |

| Q3 – 2021 | 12.60% | 15.31% | 12.36% |

| Q2 – 2021 | 11.53% | 12.23% | 5.75% |

| Q1 – 2021 | 12.90% | 7.60% | 4.80% |

| Q4 – 2020 | 28.29% | 12.35% | 22.46% |

| Q3 – 2020 | 13.62% | 16.88% | 7.84% |

| Q2 – 2020 | 24.40% | 29.08% | 24.82% |

| Q1 – 2020 | -27.27% | -21.38% | -29.43% |

| Q4 – 2019 | 4.12% | 5.77% | 7.12% |

| Q3 – 2019 | -5.83% | 0.35% | -3.30% |

| Q2 – 2019 | -3.34% | 1.44% | 1.68% |

| Q1 – 2019 | 5.79% | 6.58% | 6.96% |

| Q4 – 2018 | 1.45% | -3.82% | -1.32% |

| Q3 – 2018 | -4.96% | 2.46% | 3.29% |

| Q2 – 2018 | -2.84% | 6.83% | 4.36% |

| Q1 – 2018 | -8.32% | -4.49% | -2.14% |

| Q4 – 2017 | 13.36% | 6.76% | 5.84% |

| Q3 – 2017 | 2.96% | 6.86% | 2.54% |

| Q2 – 2017 | 5.31% | 5.58% | 3.06% |

| Q1 – 2017 | 14.77% | 8.01% | 12.16% |

| Q4 – 2016 | -8.33% | -0.78% | -6.39% |

| Q3 – 2016 | 6.23% | 5.78% | 3.40% |

Outperformance Analysis

Understanding how often a fund outperforms its benchmark or peers is crucial. Here’s a comparative analysis of the SBI Contra Fund and Parag Parikh Flexi Cap Fund in the quarterly context:

| Outperformance | SBI Contra Fund | Parag Parikh Flexi Cap Fund |

| No. Of Times | 12 | 18 |

Deciphering the numbers is like reading the language of the market. While annualized results give us a bird’s-eye view, quarterly results unveil the nuances. SBI Contra Fund and Parag Parikh Flexi Cap Fund have unique rhythms in sync with the market’s melody.

Now, we’ll delve into the risk metrics and sector allocations of two prominent funds, SBI Contra Fund and Parag Parikh Flexi Cap Fund, aiming to provide investors with a compass for their investment journey.