Introduction:

India’s thriving economy has attracted investors worldwide, with numerous companies making their mark in various industries. Market capitalisation, a vital indicator of a company’s success and market influence, measures the total value of a company’s outstanding shares. Here, you will get an up-to-date and in-depth analysis of the top 10 companies of india by market capitalisation, highlighting their achievements and significant contributions to the nation’s economy.

1. Reliance Industries Limited (RIL):

Reliance Industries Limited is first in the Top 10 Companies Of India list, led by billionaire Mukesh Ambani, the largest Indian company by market capitalisation. RIL operates across diverse sectors such as petrochemicals, refining, oil, and telecommunications. Its flagship subsidiary, Reliance Jio, has revolutionised India’s telecom industry by providing affordable internet services to millions of people.

SWOT Analysis:

Strengths: RIL is a diversified conglomerate with strengths in petrochemicals, refining, oil, and telecommunications. Reliance Jio’s subsidiary has disrupted the telecom industry with affordable internet services and innovative pricing strategies.

Weaknesses: RIL’s profitability is vulnerable to fluctuations in oil prices, and its heavy reliance on a single industry poses inherent risks.

Opportunities: RIL can explore growth and diversification by looking into new markets and sectors such as renewable energy, e-commerce, and digital services.

Threats: RIL faces intense competition, regulatory challenges, and geopolitical factors that can impact its operations.

Products and Services:

RIL operates across sectors, including refining, petrochemicals, oil and gas exploration, retail, and telecommunications. Its products range from petroleum, chemicals, and textiles to consumer goods and digital services.

Competitive Advantage:

Reliance’s competitive advantage lies in its integration across diverse sectors Which helps to achieve cost efficiencies. Its robust distribution network and digital innovation, exemplified by Reliance Jio, provide a competitive edge.

2. Tata Consultancy Services (TCS):

Second in the list of Top 10 Companies Of India is Tata Consultancy Services (TCS), a subsidiary of the Tata Group, which is a global leader in IT services and consulting. TCS offers various services, including software development, system integration, and IT consulting. With a robust global presence, TCS consistently demonstrates its prowess in the technology sector.

SWOT Analysis:

Strengths: TCS is a global leader in IT services and consulting, with a strong presence in various industry verticals. The company boasts technological expertise, a vast talent pool, and a robust delivery model.

Weaknesses: TCS is exposed to global IT services market fluctuations and currency risks. Intense competition and evolving customer demands pose ongoing challenges.

Opportunities: The demand for digital transformation, cloud computing, and artificial intelligence presents growth opportunities for TCS. Expansion into emerging markets and new technologies can drive future success.

Threats: Rapid technological advancements, evolving client requirements, and changing government regulations can threaten TCS’s business.

Products and Services:

TCS offers a wide range of IT services, including software development, system integration, infrastructure management, cloud services, and consulting. It caters to the banking, finance, healthcare, retail, and manufacturing sectors.

Competitive Advantage:

TCS differentiates itself with its strong brand reputation, global presence, and deep industry domain expertise. The company’s ability to provide end-to-end solutions, leverage emerging technologies, and deliver value-added services gives it a competitive edge.

3. HDFC Bank Limited:

Third in the list of Top 10 Companies Of India is HDFC Bank, one of India’s largest private-sector banks, is pivotal in the country’s financial sector. Renowned for its customer-centric approach and innovative banking solutions, HDFC Bank has earned a reputation for its robust performance, extensive branch network, and digital banking services.

SWOT Analysis:

Strengths: HDFC Bank is a leading private sector bank renowned for its customer-centric approach, robust risk management, and efficient operations. Its extensive network of branches and ATMs ensures convenient banking services.

Weaknesses: HDFC Bank is exposed to domestic economic fluctuations due to its heavy reliance on the Indian market—regulatory compliance and maintaining strong credit quality present ongoing challenges.

Opportunities: Expanding digital banking services, targeting rural and semi-urban markets, and increasing penetration of financial products in India offer growth prospects for HDFC Bank. International expansion and strategic partnerships can further drive success.

Threats: HDFC Bank faces competition from domestic and international banks, changing customer preferences, and regulatory changes that can impact its market position.

Products and Services:

HDFC Bank provides an extensive and comprehensive range of banking and financial services, including retail banking, corporate banking, trade finance, treasury operations, loans, credit cards, and wealth management.

Competitive Advantage:

The three main pillars of HDFC Bank’s competitive advantage comes from its substantial brand equity, customer trust, and efficient delivery of banking services. Its robust technology infrastructure, focus on digital banking, and personalised customer experience contribute to its competitive edge.

4. ICICI Bank Limited:

Fourth in the list Top 10 Companies Of India is ICICI Bank, one of India’s largest private sector banks, offers its customers a wide range of financial products and services. With a colossal network of branches and ATMs, ICICI Bank ensures convenient access to banking facilities. In addition, the bank has been at the forefront of introducing innovative banking solutions and embracing digital transformation.

SWOT Analysis:

Strengths: ICICI Bank is the second largest private sector bank in India, known for its extensive branch network, innovative banking solutions, and digital offerings. The bank has a diversified product portfolio and strong customer relationships.

Weaknesses: ICICI Bank faces intense competition in the banking industry, regulatory compliance challenges, and asset quality risks. Maintaining operational efficiency amidst technological advancements and changing customer expectations is crucial.

Opportunities: Expansion of digital banking services, focus on rural and semi-urban markets, and increasing penetration of financial products in India present growth opportunities for ICICI Bank. International expansion and strategic alliances can further drive growth.

Threats: Intense competition from domestic and international banks, changing customer preferences, and regulatory changes can threaten ICICI Bank’s market position.

Products and Services:

ICICI Bank offers a vast range of banking and financial services in retail banking, corporate banking, trade finance, loans, credit cards, and wealth management. The bank also provides digital banking services and has a solid online and mobile banking presence.

Competitive Advantage:

ICICI Bank’s competitive advantage lies in its extensive branch network, advanced technology infrastructure, and focus on customer-centric services. The bank’s innovative product offerings, personalised banking experience, and robust risk management practices contribute to its competitive edge.

5. Hindustan Unilever Limited (HUL):

Fifth in the list of Top 10 Companies Of India is Hindustan Unilever Limited (HUL), a subsidiary of Unilever, is India’s largest consumer goods company. HUL offers a vast portfolio of products across various categories, including personal care, food and beverages, and home care. The company’s famous brands, such as Dove, Lux, and Surf Excel, have become household names in India.

SWOT Analysis:

Strengths: HUL is India’s largest consumer goods company, with a vast portfolio of popular brands. The company enjoys substantial brand equity, extensive distribution channels, and a deep understanding of the Indian market.

Weaknesses: HUL faces price volatility of raw materials, intense competition from local and international brands, and changing consumer preferences. The company’s reliance on a few key brands exposes it to risks associated with brand loyalty and product lifecycle.

Opportunities: The Rising growth opportunities for HUL lie in disposable incomes, urbanisation, and increased consumer awareness. The company can also explore expanding its product portfolio and entering new markets.

Threats: Changing consumer preferences, regulatory challenges, and the emergence of local competitors can threaten HUL’s market share.

Products and Services:

HUL offers a wide range of consumer goods, including personal care products, home care products, food and beverages, and water purifiers. Its famous brands include Dove, Lux, Surf Excel, Knorr, and Brooke Bond.

Competitive Advantage:

HUL’s competitive advantage lies in 3 strengths, and they are extensive

1. product portfolio,

2. strong distribution network, and

3. Deep understanding of the Indian consumer.

The company’s focus on innovation, quality, and sustainability further enhances its competitive edge.

6. ITC Limited:

Sixth this list of Top 10 Companies Of India is ITC Limited is a diversified conglomerate interested in various sectors, including cigarettes, FMCG (Fast-Moving Consumer Goods), hotels, paperboards, and packaging. The company has significantly contributed to the Indian economy through its many favoured brands, such as Aashirvaad, Bingo, and Sunfeast.

SWOT Analysis:

Strengths: ITC Limited is a diversified conglomerate interested in multiple sectors, including cigarettes, FMCG (Fast-Moving Consumer Goods), hotels, paperboards, and packaging. The company enjoys substantial brand equity, a vast distribution network, and a deep understanding of the Indian market.

Weaknesses: ITC Limited faces challenges related to regulatory restrictions, changing consumer preferences, and sustainability concerns in the tobacco industry. Dependency on a few key brands and exposure to commodity price fluctuations are areas for improvement.

Opportunities: ITC Limited can leverage its strong distribution network, brand reputation, and product innovation capabilities to expand its FMCG portfolio, enter new markets, and focus on sustainable and organic products.

Threats: Intense competition from domestic and international players, changing regulatory landscape, and evolving consumer preferences threaten ITC Limited’s market share.

Products and Services:

ITC Limited offers various products across multiple sectors. Its portfolio includes cigarettes, personal care products, packaged food and beverages, agarbattis (incense sticks), stationery products, hotels, and paperboards.

Competitive Advantage:

ITC Limited’s competitive advantage stems from its

- Diversified business portfolio,

- Strong brand presence, and

- Deep distribution network.

The company’s focus on innovation, sustainability, and social responsibility further enhances its competitive edge.

7. Infosys Limited:

Seventh in the list of Top 10 Companies Of India is Infosys is a market leader in next-generation digital services and consulting and is now also in AI. Renowned for its cutting-edge technologies and transformative solutions, Infosys helps businesses navigate the digital landscape. This company plays a pivotal role in the growth of India’s IT sector and boasts a solid global presence.

SWOT Analysis:

Strengths: Infosys is a global leader in digital services and consulting, known for its technological expertise, scalable delivery model, and strong client relationships. The company has a large and diverse client base and a robust presence in multiple industry domains.

Weaknesses: The dynamic nature of the IT industry and evolving customer demands pose challenges for Infosys. In addition, talent retention, intense competition, and maintaining profitability amidst pricing pressures are ongoing concerns.

Opportunities: The increasing demand for digital transformation, cloud computing, artificial intelligence, and automation provides significant growth opportunities for Infosys. Expansion into emerging markets and strategic acquisitions can drive future success.

Threats: Rapid technological advancements, geopolitical uncertainties, and changing regulatory landscapes can threaten Infosys’s operations and client base.

Products and Services:

Infosys offers a wide range of IT services, including software development, system integration, application management, consulting, and digital solutions. The company caters to various industries, including banking, finance, healthcare, retail, and manufacturing.

Competitive Advantage:

Infosys’s competitive advantage stems from its,

1. Global presence,

2. Strong brand reputation, and

3. Comprehensive service offerings.

The company’s focus on innovation, agility, and value-driven solutions differentiates it from competitors.

8. State Bank of India (SBI):

Eight in this list of Top 10 Companies Of India is State Bank of India (SBI), India’s largest and one of the oldest public sector banks, serves millions of customers with its banking and financial services. With one of the enormous networks of branches and ATMs, SBI has a strong presence nationwide. As a result, the bank plays a vital role in driving financial inclusion and supporting economic growth.

SWOT Analysis:

Strengths: State Bank of India is the largest public sector bank in India, known for its extensive branch network, solid customer base, and robust risk management practices. The bank has a diverse product portfolio and an undisputable position in the Indian banking sector.

Weaknesses: SBI faces challenges related to bureaucratic processes, slow decision-making, and adapting to changing customer expectations in the digital era. Maintaining asset quality and operational efficiency are ongoing concerns.

Opportunities:

- Expanding digital banking services,

- leveraging technology for customer acquisition and

- Retention and focusing on financial inclusion present growth opportunities for SBI.

The bank can also explore international expansion and strategic partnerships.

Threats: Intense competition from domestic and international banks, changing regulatory landscape, and economic fluctuations can threaten SBI’s market position.

Products and Services:

State Bank of India offers various banking and financial services, including retail banking, corporate banking, trade finance, loans, credit cards, wealth management, and digital banking solutions.

Competitive Advantage:

SBI’s competitive advantage lies in its,

- Extensive branch network,

- Strong brand reputation, and

- Comprehensive product offerings.

The bank’s focus on financial inclusion, digital initiatives, and personalised customer experience contributes to its competitive edge.

9. Kotak Mahindra Bank Limited:

Ninth in the list of Top 10 Companies Of India is Kotak Mahindra Bank is a prominent private sector bank in India, providing comprehensive financial services to individuals and businesses. The bank has experienced remarkable growth and has established a strong reputation for its customer-centric approach and technological advancements.

SWOT Analysis:

Strengths: Kotak Mahindra Bank is a leading private sector bank in India, known for its strong capital adequacy, efficient operations, and robust risk management practices. The bank has a diverse product portfolio and a solid customer base.

Weaknesses: The bank faces intense competition in the banking industry, regulatory challenges, and the need to balance growth with maintaining asset quality. Adapting to technological advancements and changing customer expectations is an ongoing challenge.

Opportunities: Expansion of digital banking services, focus on rural and semi-urban markets, and increasing penetration of financial products in India present growth opportunities for Kotak Mahindra Bank. International expansion and strategic alliances can further drive growth.

Threats: Intense competition from domestic and international banks, changing customer preferences, and regulatory changes can threaten Kotak Mahindra Bank’s market position.

Products and Services:

Kotak Mahindra Bank offers a varied and comprehensive range of banking and financial services, including retail banking, corporate banking, trade finance, loans, credit cards, and wealth management. The bank also provides digital banking services and has a solid online and mobile banking presence.

Competitive Advantage:

Kotak Mahindra Bank’s competitive advantage lies in its customer-centric approach, robust risk management practices, and focus on innovation. The bank’s robust technology infrastructure, personalised banking experience, and diverse product offerings contribute to its competitive edge.

10. Larsen & Toubro Limited (L&T):

Tenth in this list of Top 10 Companies Of India is Larsen & Toubro is a leading engineering conglomerate and construction company in India. It has a diverse portfolio of projects, including infrastructure, power, defence, and technology. L&T has played a crucial role in shaping India’s infrastructure landscape and enjoys a solid international presence.

SWOT Analysis:

Strengths: Larsen & Toubro is a leading engineering conglomerate and construction company in India, known for its strong project execution capabilities, diversified business portfolio, and technological expertise. The company works in multiple sectors: infrastructure, power, defence, and technology.

Weaknesses: L&T faces challenges related to project delays, regulatory complexities, and execution risks associated with large-scale projects. The company’s exposure to economic fluctuations and dependency on government contracts are ongoing concerns.

Opportunities: Infrastructure development, urbanisation, and government initiatives present growth opportunities for L&T. The company can leverage its expertise in emerging sectors such as renewable energy, smart cities, and digital transformation.

Threats: Intense competition, changing government policies, and global economic uncertainties can threaten L&T’s market position and project pipeline.

Products and Services:

L&T offers a wide range of products and services, including engineering, procurement, and construction (EPC) services, infrastructure development, power generation, defence and aerospace solutions, technology and IT services, and industrial manufacturing.

Competitive Advantage:

L&T’s competitive advantage lies in its,

- Extensive industry experience,

- Strong project management capabilities, and

- Technological expertise.

The company’s ability to execute complex projects, focus on quality and safety, and diversify its business portfolio contribute to its competitive edge.

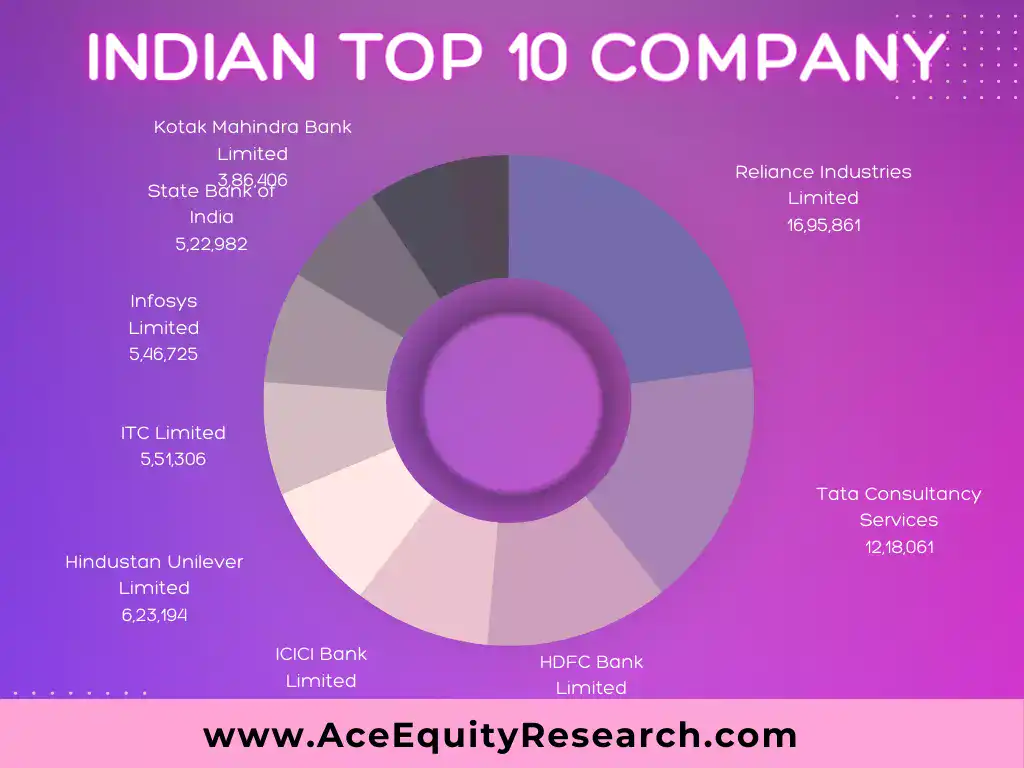

Summary of Top 10 Companies Of India:

| Sr. No. | Company Name | Market Cap (Crores) ₹ |

| 1 | Reliance Industries Limited | 16,95,861 |

| 2 | Tata Consultancy Services | 12,18,061 |

| 3 | HDFC Bank Limited | 9,02,910 |

| 4 | ICICI Bank Limited | 6,64,658 |

| 5 | Hindustan Unilever Limited | 6,23,194 |

| 6 | ITC Limited | 5,51,306 |

| 7 | Infosys Limited | 5,46,725 |

| 8 | State Bank of India | 5,22,982 |

| 9 | Kotak Mahindra Bank Limited | 3,86,406 |

| 10 | Larsen & Toubro Limited | 3,11,819 |

Conclusion:

Top 10 Companies Of India by market capitalisation showcase the diversity and strength of the Indian corporate landscape. Each company possesses unique strengths, weaknesses, opportunities, and threats that shape its operations and market position. These ten companies are the market leaders in their respective industries by offering various products and services, leveraging technological advancements, and prioritising customer-centric approaches. Their competitive advantages, coupled with their contributions to the Indian economy, solidify their positions as key players in the Indian market.

FAQs

Who is No 1 company in India?

The No. 1 company in India by market capitalization is Reliance Industries Limited (RIL), led by billionaire Mukesh Ambani. However, please note that market dynamics can change over time.

Which Indian company has the highest market capitalization in 2023?

As of May 2023, Reliance Industries Limited (RIL) had the highest market capitalisation among Indian companies. However, please note that market capitalization values are subject to change as they are influenced by factors such as stock prices, market fluctuations and other economic factors.

Which Indian company has the highest market capitalisation in 2022?

As of Dec 2022, Reliance Industries Limited (RIL) had the highest market capitalisation among Indian companies. However, please note that market capitalisation values are subject to change as they are influenced by factors such as stock prices and market fluctuations.

Does market cap affect stock price?

Market capitalisation and stock prices share a complex relationship, and changes in the market cap can impact stock prices. Market capitalisation is calculated by multiplying a company’s outstanding shares by its stock price. It represents the total market value of a company’s equity.

On the other hand, stock prices are influenced by a range of factors, including market dynamics, investor sentiment, company performance, industry trends, and broader economic conditions. While market capitalisation doesn’t directly determine stock prices, it can contribute to market perception and investor behaviour, subsequently influencing stock prices.

Companies with larger market capitalisations often attract more attention from investors, analysts, and institutional funds. The higher market cap may indicate stability, market influence, and growth potential, which can generate more demand for the stock and potentially drive its price higher.

Conversely, companies with smaller market capitalizations may face challenges in generating investor interest and liquidity. The lower market cap can result in lower trading volumes, limited analyst coverage, and increased price volatility.

It’s important to note that market capitalisation is just one factor among many that can impact stock prices. Fundamental elements such as financial performance, earnings, revenue growth, competitive landscape, and industry trends also play significant roles in determining stock prices.

Therefore, while market capitalisation can influence stock prices, it is crucial to consider a comprehensive range of factors and conduct a thorough analysis before making investment decisions.

Is a high market cap good?

Having a high market capitalisation is generally considered advantageous for a company. Market capitalisation represents the total value of a company’s outstanding shares and is calculated by multiplying the current share price by the number of outstanding shares. A high market cap indicates that the market views the company as valuable and has confidence in its prospects. Here are some reasons why a high market capitalisation is seen as positive:

Stability and Size: Companies with high market capitalisations are typically well-established and more prominent in size. They often have a solid track record, a strong market presence, and financial stability. This stability can provide reassurance to investors and reduce perceived risk.

Investor Confidence: A high market capitalisation demonstrates that investors have confidence in the company’s ability to generate consistent earnings and deliver value over time. It suggests that the company is perceived as a leader in its industry and is capable of withstanding market fluctuations.

Access to Capital: Companies with high market capitalisations generally have better access to capital.

They can raise funds through stock offerings or bond issuances, enabling them to finance growth initiatives, research and development, and strategic acquisitions. Accessing capital easily is beneficial for expanding operations and seizing opportunities.

Brand and Reputation: High market capitalisation often correlates with a strong brand image and a positive reputation. Companies with a high market cap are typically well-known and respected in their respective industries. A solid brand and reputation can attract customers, investors, and talented employees.

However, it is essential to note that a high market capitalisation alone does not guarantee a company’s success or profitability. Numerous factors influence a company’s performance, including market conditions, industry dynamics, and internal operations. Investors should conduct thorough research and analysis beyond market capitalisation to make well-informed investment decisions.

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory. This is not an investment advisory. The blog is for information purposes only. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Past performance is not indicative of future returns. Please consider your specific investment requirements, risk tolerance, goal, time frame, risk and reward balance, and the cost associated with the investment before choosing a fund or designing a portfolio that suits your needs. The performance and returns of any investment portfolio can neither be predicted nor guaranteed.

The information provided in this article is solely the author/advertisers’ opinion and not investment advice – it is provided for educational purposes only. Using this, you agree that the information does not constitute any investment or financial instructions by Ace Equity Research and the team. Anyone wishing to invest should seek their own independent financial or professional advice. Do conduct your research along with financial advisors before making any investment decisions. Ace Equity Research and the team are not accountable for the investment views provided in the article.